Happy New Year 2020 and beyond to all!

This is the TRADE COMMENTARY for TUESDAY: December 31, 2019:

New Trial Subscribers: Due to the slow activity during the holidays, your free trials will be extended through January 31, 2020.

Today’s Comments:

I’ll summarized the current positions in today’s newsletter and I also want to discuss some of trades I expect to be making in the New Year 2020.

Summary of Current Positions:

MAR20 365-strike PUT option for 2.125 cents ($106.25) each.

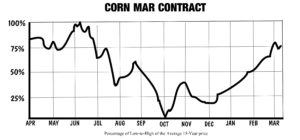

This morning this short Corn option is trading at 1.626/1.875 bid/ask. I expect the MAR2020 corn futures to follow their normal seasonal pattern and to seek a higher price over the next month or two. Here’s the chart for the normal seasonal pattern of the MAR Corn Futures:

Corn continued: Here’s the chart of the MAR20 corn Futures when I placed the trade on 17 DEC 2019:

You see the MAR20 Corn futures were 390.25. This morning, this contract is trading almost the same at 387.50. This option as of this morning, has an 84% chance of expiring OTM (worthless) in 52 days on 21FEB2020.

MARCH 2020 CRUDE OIL short strangle: I sold the 70 Calls and the 45 Puts @ 0.14 for each of then, total of 0.28 ($280.) Trade Date: 10 DEC 2019:

Here’s the chart from 10DEC2019 when I sold these short strangles:

And here’s the chart of the Crude Oil short strangle as of this morning 31DEC2019: BTW, the trade price about .19 today, so an unrealized profit of about $90 so far on each strangle.

Crude Oil continued: Most of the analyst expect Crude Oil to trade between $45 and $65 per barrel during calendar 2020. Of course that assumes no bombed oil fields or Mideast conflicts that might disrupt supply. In September of 2019 for the first time in over 40 years, the USA became a next exporter of Crude Oil. There are plenty of reserves and oil pumping operations to maintain this trend. At prices near or over $60 per barrel, the USA will likely maintain high levels of production. I think there should be many opportunities during 2020 to continue to sell short strangles on Crude. I expect about mid January 2020 to shop for more short strangles and to be able to take a profit on this current position.

Gold position and commentary: Just a reminder because it is sometimes confusing for traders, remember this short MAR20 option is on the underlying contract for APR2020. The reason is simple; there is NO MAR2020 futures traded on Gold. (commentary continued below chart.)

MARCH 2020 Gold 1350-strike PUT for 0.80 ($80) Trade Date: 10 DEC 2019

This is the chart on the day I initiated the trade. Gold was trading about 1474.70. This morning the underlying April 2020 Gold is trading at $1524.50, clearly in favor of this short PUT trade. At the time I placed this trade, I noted that since the DJIA / stock market and indexes were at all-time highs, that I would choose NOT to sell a CALL and form a short strangle. The reason I cited still stands: that the stock market could experience one of those large sell-off days which (they usually) cause a spike UP in Gold prices. Gold and the stock market indexes have an inverse price relationship. I suggest you create a chart in your trading platform that displays both Gold and the S&P500 Index; this will give you a chart that displays this inverse price relationship of the two. It isn’t that I’m “predicting” a fall in the stock market; I’m just saying it never continues in a straight line UP and UP and UP and there will be correction days ahead. When/if that happens Gold prices will spike UP and I might use that opportunity to take profits on the existing short PUT, and also it might provide an opportunity to sell a Gold CALL for a good premium. Selling the CALL right now, I feel, would place me in jeopardy of Gold prices going against a short CALL. I will wait for an opportunity to sell a CALL – and I do feel there will be an opportunity to do so soon. BTW, there option trading for 0.3 today so an unrealized profit of about $50 so far.

Selling options on Gold has been very lucrative over the past year and I will continue to sell the options throughout calendar 2020.

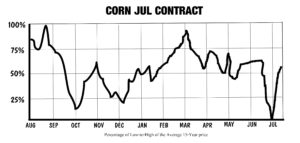

Here’s a chart of the JUL contract over the last 15 years that illustrates the seasonal pattern for the JUL contract (below.) If you were a subscriber during this 2019 year, you will recall that spring floods of 2019’s season delayed plantings and reduced estimated yields. Events like that often skew normal seasonal patterns and that is what happened to the 2019 crop prices; this makes it more difficult to trade a ‘normal’ seasonal pattern. It is unlikely that two years in a row will be like that, so I expect to have several sets of options to selll for the new crop 2020/2021 of Corn. Coming up first, I will be shopping to sell JUL2020 Corn PUTS. The July 2020 Corn Futures are trading about $4.00 per bushel right now. Another disruption for calendar 2019 was /is the China/USA so-called “trade wars” or disputes. Even though the first phase agreement is scheduled to be signed this week, this won’t be an end to trade talks and negotiations – and these can/do affect the market in many ways. The upcoming WASDE (World Ag Supply-Demand Estimates by USDA) for January coming up very soon and this report will have the most accurate numbers for the actual Corn harvest for this past season. Since all the harvesting is now completed, accurate numbers for production and yield and the corn in storage will be available. I will wait for that number before placing any more corn trades. Having said that, I expect to be able to sell JULY2020 PUTS very soon. And my favorite option-sell on corn is to sell the DEC contracts (meaning the DEC2020) some time in or near JUNE/JULY as the DEC futures prices peak. I will describe that strategy more in depth here, when the time comes. Below are both the seasonal price charts for JUL and DEC in Corn:

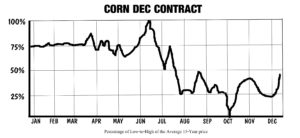

As you can see (directly below), the DEC contract of Corn normally peaks in JUN/JUL. One of my favorite and more reliable trades is to sell some DEC CALL strikes during JUN/JUL time period. Due to the flooding and late planting in 2019, this was difficult to do as that uncertainty kept prices higher than they would have normally been into the FALL harvest season. Trade negotiations also played a part in that.

There are over 110 seasonal charts in my book available from Amazon, titled:

Comments Continued:

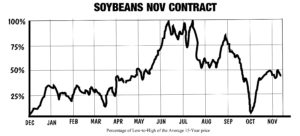

Unless you have followed the grain markets and have a lot of experience with them, you may not know that the USA’s biggest customer BY FAR for Soybeans is China. Trade disruptions and an oversupply of Soybeans during calendar 2019, kept soybean prices below $10 a bushel almost all year. This is VERY unusual. By comparison, the USA exports very little Corn to China. New laws that are going to allow USA gasoline to contain up to 15% ethanol (from Corn of course) will go into effect this year. This may improve corn demand, as the USA does export a lot of ethanol. Soybeans are still too abundant/available to get prices a lot higher, but this market has a history of large price swings. A lot will depend on the ACTUAL (as compared to the political rhetoric talk) purchases of soybeans by China. The market gets faked out when rumors of ‘large buys from China’, hit the headlines. When it actually happens for a prolonged period of time (over several months), not just the ‘token purchases,’ this could drive bean prices back up to $12 and higher. We’ll just have to wait and see. 2019 was year of what I will call “fake headlines” about forward strides in trade between USA/China.

Should the trade talks get bogged down again (not an unlikely thing), bean prices could sink to even lower levels, and there could be option-selling opportunities available. I’ll be watching for such opportunity.

I think there will be many opportunities in 2020 to sell some options relatively safely, provided one studies the fundamentals of the markets and remains patient and tolerant of delays in trade talks and gives ample study to the USDA and EIA reports.

A great 2020 New Year to each of you and thank you. – Don

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Happy New Year 2020 and beyond to all!

This is the TRADE COMMENTARY for TUESDAY: December 31, 2019:

New Trial Subscribers: Due to the slow activity during the holidays, your free trials will be extended through January 31, 2020.

Today’s Comments:

I’ll summarized the current positions in today’s newsletter and I also want to discuss some of trades I expect to be making in the New Year 2020.

Summary of Current Positions:

MAR20 365-strike PUT option for 2.125 cents ($106.25) each.

This morning this short Corn option is trading at 1.626/1.875 bid/ask. I expect the MAR2020 corn futures to follow their normal seasonal pattern and to seek a higher price over the next month or two. Here’s the chart for the normal seasonal pattern of the MAR Corn Futures:

Corn continued: Here’s the chart of the MAR20 corn Futures when I placed the trade on 17 DEC 2019:

You see the MAR20 Corn futures were 390.25. This morning, this contract is trading almost the same at 387.50. This option as of this morning, has an 84% chance of expiring OTM (worthless) in 52 days on 21FEB2020.

MARCH 2020 CRUDE OIL short strangle: I sold the 70 Calls and the 45 Puts @ 0.14 for each of then, total of 0.28 ($280.) Trade Date: 10 DEC 2019:

Here’s the chart from 10DEC2019 when I sold these short strangles:

And here’s the chart of the Crude Oil short strangle as of this morning 31DEC2019: BTW, the trade price about .19 today, so an unrealized profit of about $90 so far on each strangle.

Crude Oil continued: Most of the analyst expect Crude Oil to trade between $45 and $65 per barrel during calendar 2020. Of course that assumes no bombed oil fields or Mideast conflicts that might disrupt supply. In September of 2019 for the first time in over 40 years, the USA became a next exporter of Crude Oil. There are plenty of reserves and oil pumping operations to maintain this trend. At prices near or over $60 per barrel, the USA will likely maintain high levels of production. I think there should be many opportunities during 2020 to continue to sell short strangles on Crude. I expect about mid January 2020 to shop for more short strangles and to be able to take a profit on this current position.

Gold position and commentary: Just a reminder because it is sometimes confusing for traders, remember this short MAR20 option is on the underlying contract for APR2020. The reason is simple; there is NO MAR2020 futures traded on Gold. (commentary continued below chart.)

MARCH 2020 Gold 1350-strike PUT for 0.80 ($80) Trade Date: 10 DEC 2019

This is the chart on the day I initiated the trade. Gold was trading about 1474.70. This morning the underlying April 2020 Gold is trading at $1524.50, clearly in favor of this short PUT trade. At the time I placed this trade, I noted that since the DJIA / stock market and indexes were at all-time highs, that I would choose NOT to sell a CALL and form a short strangle. The reason I cited still stands: that the stock market could experience one of those large sell-off days which (they usually) cause a spike UP in Gold prices. Gold and the stock market indexes have an inverse price relationship. I suggest you create a chart in your trading platform that displays both Gold and the S&P500 Index; this will give you a chart that displays this inverse price relationship of the two. It isn’t that I’m “predicting” a fall in the stock market; I’m just saying it never continues in a straight line UP and UP and UP and there will be correction days ahead. When/if that happens Gold prices will spike UP and I might use that opportunity to take profits on the existing short PUT, and also it might provide an opportunity to sell a Gold CALL for a good premium. Selling the CALL right now, I feel, would place me in jeopardy of Gold prices going against a short CALL. I will wait for an opportunity to sell a CALL – and I do feel there will be an opportunity to do so soon. BTW, there option trading for 0.3 today so an unrealized profit of about $50 so far.

Selling options on Gold has been very lucrative over the past year and I will continue to sell the options throughout calendar 2020.

Here’s a chart of the JUL contract over the last 15 years that illustrates the seasonal pattern for the JUL contract (below.) If you were a subscriber during this 2019 year, you will recall that spring floods of 2019’s season delayed plantings and reduced estimated yields. Events like that often skew normal seasonal patterns and that is what happened to the 2019 crop prices; this makes it more difficult to trade a ‘normal’ seasonal pattern. It is unlikely that two years in a row will be like that, so I expect to have several sets of options to selll for the new crop 2020/2021 of Corn. Coming up first, I will be shopping to sell JUL2020 Corn PUTS. The July 2020 Corn Futures are trading about $4.00 per bushel right now. Another disruption for calendar 2019 was /is the China/USA so-called “trade wars” or disputes. Even though the first phase agreement is scheduled to be signed this week, this won’t be an end to trade talks and negotiations – and these can/do affect the market in many ways. The upcoming WASDE (World Ag Supply-Demand Estimates by USDA) for January coming up very soon and this report will have the most accurate numbers for the actual Corn harvest for this past season. Since all the harvesting is now completed, accurate numbers for production and yield and the corn in storage will be available. I will wait for that number before placing any more corn trades. Having said that, I expect to be able to sell JULY2020 PUTS very soon. And my favorite option-sell on corn is to sell the DEC contracts (meaning the DEC2020) some time in or near JUNE/JULY as the DEC futures prices peak. I will describe that strategy more in depth here, when the time comes. Below are both the seasonal price charts for JUL and DEC in Corn:

As you can see (directly below), the DEC contract of Corn normally peaks in JUN/JUL. One of my favorite and more reliable trades is to sell some DEC CALL strikes during JUN/JUL time period. Due to the flooding and late planting in 2019, this was difficult to do as that uncertainty kept prices higher than they would have normally been into the FALL harvest season. Trade negotiations also played a part in that.

There are over 110 seasonal charts in my book available from Amazon, titled:

Available on Amazon with free prime shipping.

Comments Continued:

Unless you have followed the grain markets and have a lot of experience with them, you may not know that the USA’s biggest customer BY FAR for Soybeans is China. Trade disruptions and an oversupply of Soybeans during calendar 2019, kept soybean prices below $10 a bushel almost all year. This is VERY unusual. By comparison, the USA exports very little Corn to China. New laws that are going to allow USA gasoline to contain up to 15% ethanol (from Corn of course) will go into effect this year. This may improve corn demand, as the USA does export a lot of ethanol. Soybeans are still too abundant/available to get prices a lot higher, but this market has a history of large price swings. A lot will depend on the ACTUAL (as compared to the political rhetoric talk) purchases of soybeans by China. The market gets faked out when rumors of ‘large buys from China’, hit the headlines. When it actually happens for a prolonged period of time (over several months), not just the ‘token purchases,’ this could drive bean prices back up to $12 and higher. We’ll just have to wait and see. 2019 was year of what I will call “fake headlines” about forward strides in trade between USA/China.

Should the trade talks get bogged down again (not an unlikely thing), bean prices could sink to even lower levels, and there could be option-selling opportunities available. I’ll be watching for such opportunity.

I think there will be many opportunities in 2020 to sell some options relatively safely, provided one studies the fundamentals of the markets and remains patient and tolerant of delays in trade talks and gives ample study to the USDA and EIA reports.

A great 2020 New Year to each of you and thank you. – Don

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.