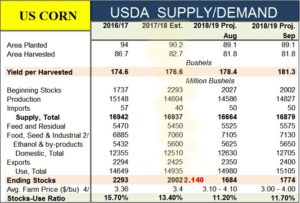

Corn: Even though I exited my 400 DEC18 corn CALLs, some of you may still be in that or a similar trade – so I’ll comment on it. The DEC18 Corn closed on Friday at 356.50 down -8.5 cents for the day and the 400-strike CALL is last traded at .875. Here’s what happened on Friday: The September 1st stocks report by USDA – was considered bearish with September 1st stocks coming in at 2.140 billion bushels versus the average estimate of 2.010 billion bushels (1.953-2.099 billion range) and compared to last year’s 2.293 billion bushels. To be clear: This is saying the stocks for this season 2017/18 Est. have been raised by 130 million bushels.

This means (see table 2.140 in RED ) the “Ending Stocks” for 2017-18 was raised by 6.5%. This resulted in the DEC18 Corn trading down to 356.50. Unless, the October 11th WASDE report lowers the expected yield, the record 181.3 bushels/acre, the Corn futures have probably made a high for the season.

Soybeans: About 30 million bushels were added to the the September 1st stocks report for soybeans was considered bearish with September 1st stocks coming in at 438 million bushels versus the average estimate of 398 million bushels and compared to last year’s 302 million bushels. The beginning stocks for the 2018-19 year came in well above expectations also. Some analyst believe, since Brazilian soybeans are now more than 25% higher than USA soybean prices, this could offer price support at least short-term for soybeans. This is by no means bullish and as harvest progresses this fall (Norther Hemisphere), prices could drift down more. The tariff status is of course a wild card, but it doesn’t look like any changes are in the immediate future.

Gold: As indicated on the most recent Trade Summary Sheet in the newsletter: I am short the DEC18 Gold 1400C/1050P strangle. This strangle expires on 11/27/2018, only 58 days away. Here’s the current chart:

I am also short an even “wider” FEB19 Gold 1500C/1000P strangle (not shown here), that expires in about 120 days on January 19, 2019. At present, I am very comfortable with both these short strangle positions. The FED indicated another raise in interest rates, which will continue strength in the $DXY / $US dollar Index. Should the stock market have a huge correction, it could drive gold prices up more as investors run for a ‘safe haven’ investment. There is always talk and speculation about these possibilities. All the short strikes I have sold are so far OTM (out-of-the-money), and all have such low Deltas, that I could get ‘out of the way’ if there is any drastic change in the present outlook. The chart (above) illustrates this point. At present, the 1400 CALL is over $200 OTM and the 1050 PUT is almost $150 OTM. The FEB19 strangles are even farther OTM (“wider”.)

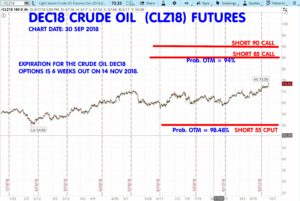

Crude: I often mention my friends at OptionSellers.com They are very capable and smart money mangers and are sellers of commodity options for their clients. They handle money for large investors and their account minimum is $500,000. They do a spectacular job for their clients. They also have a great blog, and just last week posted what I think is a great article on the Crude Oil longer-term price outlook, making many salient points. The title of the article is: CRUDE OIL UPDATE: OPEC Headlines the Gift that Keeps on Giving to Call Sellers. I suggest you give this article a read, here’s the LINK.

As of late, Crude Oil futures have been on the rise, and still could go a little higher in the short-term. The prospects for the short DEC18 options looks to be ok for now. The “Prob. OTM”, the probability the option will expire OTM (Out-of-the-Money) remains high. With only 6 weeks to go, the odds are good for these trades. I should note here that the “Prob. OTM” statistic does NOT factor in a market’s fundamentals. The “Prob.OTM” is a Black-Scholes or similar derivation based on: volatility of the underlying contract, days until expiration, and how far OTM the strike is. I do not trade solely on this number, but it is, for me, a very important consideration.

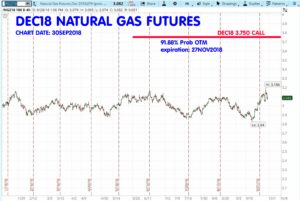

Natural Gas: I am short the DEC18 NGZ18 3.750-strike. It is 91.88% Prob. OTM and expires in 58 days on 27NOV2018. I do not foresee at present this option reaching the strike. Here’s the chart as of 30SEP2018:

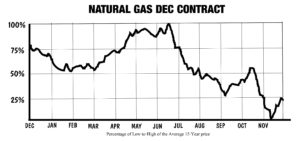

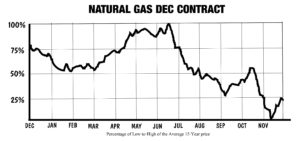

Here is the seasonal price pattern, the 15-year average for the DEC Natural Gas futures.  I’ve posted it here before of course. Some traders refer to the drop off in NG prices between times of (Norther Hemisphere) hot weather of summer and the cold weather of winter as a “shoulder”, referring to the price pattern of this seasonal price retreat. I have a book with all the contract’s price 15 year patterns for 14 commodity markets. While it is a valuable tool to use in commodity trading, I would never trade armed with only the seasonal pattern info, I also want to follow a market’s seasonal fundamentals and be aware of tariffs, politics, conflicts, and many other factors that influence price. There are plenty of examples over the years of “counter seasonal price moves.” Sales and purchases of commodities in these markets can get “overdone” in either direction. So be aware that while these charts can be a great tool, it is just one of many items a trader must consider.

I’ve posted it here before of course. Some traders refer to the drop off in NG prices between times of (Norther Hemisphere) hot weather of summer and the cold weather of winter as a “shoulder”, referring to the price pattern of this seasonal price retreat. I have a book with all the contract’s price 15 year patterns for 14 commodity markets. While it is a valuable tool to use in commodity trading, I would never trade armed with only the seasonal pattern info, I also want to follow a market’s seasonal fundamentals and be aware of tariffs, politics, conflicts, and many other factors that influence price. There are plenty of examples over the years of “counter seasonal price moves.” Sales and purchases of commodities in these markets can get “overdone” in either direction. So be aware that while these charts can be a great tool, it is just one of many items a trader must consider.

The ICE markets and the Meats: I do a lot of my trading from the ThinkOrSwim(tm) platform by TD Ameritrade. While I enjoy the platform and the SPAN minimum margin requirements it provides, it does have some short-comings. For someone new to commodity trading, the list of all the markets looks daunting. There are far more than 50 different futures type contracts. While this is true, most of the trading in the commodity markets are done in less than a dozen markets: mostly corn, wheat, soybeans, silver, gold, crude oil, natural gas, RBOB (unleaded gas), cotton, coffee, and cocoa, live cattle, feeder cattle, and live hogs.

TOS (ThinkOrSwim) does not trade any futures or options of the category called the “softs,” these are (primarily) orange juice, cotton, coffee, and cocoa. TOS does not trade options on the meats: Live Cattle, Feeder Cattle, and Live Hogs. The softs are all traded on ICE (InterContinentalExchange) based in Atlanta, GA. CME, the Chicago Mercantile Exchange, is where the meats are traded.

Can a small trader do well while using only ThinkOrSwim? Certainly she/he can – and many small/medium traders do it all the time. This is just personal opinion, but I have to say that TD Ameritrade / ThinkOrSwim is fantastic. I’ve used them for years and they have one of the best customer service and support found anywhere in the world.

Personally, I like trading the following commodities NOT handled by TOS or many other brokers: silver, live cattle, feeder cattle, live hogs, coffee, and cotton. There are opportunities for commodity option sellers in these markets that should not be ignored (in my opinion.) I have personal accounts where I can trade some of these markets, but some of the brokers I use ( and have used) do NOT use SPAN minimum, and some of them require $25,000 minimum or higher account size to open.

I am currently- and have been for a few weeks, trying some demo programs that I can recommend for those who wish to trade ALL the markets in my list above while getting SPAN minimum, low commissions, and good customer service. Soon, probably within two weeks – will put comments here about them. Some are quite promising for small/medium investors. My list will not be comprehensive, as I don’t have time to try 40 different on-line brokers and comment on each one. I will merely pick out two or three that are, in my personal opinion, quite suitable and tell you about them. And I will list them on the page at this website at the tab Resource: Links Library.

One of the difficulties for small/medium investors is being able to trade the ICE softs futures. CBOT, CME, and almost all commodity markets have very low fees in order to receive live quotes. So low, that many brokers easily absorb those fees and give them to their customers free; others might charge $15 to $30 a month for all these many markets- and that seems a fair price, unlike those the ICE demands. The ICE is the single exception. ICE exchange charges EACH INDIVIDUAL INVESTOR around $1300 year to get live quotes on their futures that include: orange juice, cotton, coffee, and cocoa. Their policy is very unpopular for (I think) obvious reasons. For a large investor or institutional traders, and large corporate hedgers – their fee might seem relatively small.

There is a way that some brokers will allow their customers to trade ICE futures and options without LIVE quotes (the ones that cost $1300 a year to get.) They allow customers to receive delayed quotes; these quote are delayed up to :30 minutes. For the type of trading we do, this can work just fine. Why? Because we aren’t doing day-trading or trying to scalp some money off of quick in-and-out trades (that would definitely require live quotes.) I found there is a further complication ’caused’ by ICE’s policy; the ICE does NOT allow live or delayed quotes on any broker’s DEMO software. However, ICE will allow (free) quotes so long as they are delayed in actual accounts (just not he DEMO’s versions). This means you cannot paper-trade ICE futures in DEMO accounts, but once your account is active and funded, you can trade them using free delayed quotes. I hasten to add, this is done by many traders that just do not feel the type of trading they do requires the LIVE quotes, aka: real-time quotes.

I have, during the last year, listed trades in my newsletter on futures at the ICE, but have not done any lately. I feel I am missing some opportunities by not using those markets. I particularly think there are some great opportunities in the meats, coffee, and cotton. In coming weeks, I will be listing those in my trading. Whether you choose to use them or not, is entirely up to you. I feel it is quite possible to do very well without them. It is a personal choice. I am not suggesting you ditch your broker if they don’t allow trading ICE futures with or without the $1300 / year fees. I want to be clear about that. Most of my trades will continue to be NOT in the ICE futures. My hope is that one day, they will have a better policy on quote fees that will be more accommodating to small/med traders.

Having said all this, I will share my findings with you very soon – and I hope you will find them useful for your own application. I do not get paid by any broker or receive any compensation in any form from them. FYI: I am not a broker, nor a money-manager, nor do I want to be either. I am a writer and educator; the only products I sell are my books and newsletter.

Looking Forward to the week: Since Crude Oil has been going up, I may be able to take some profits in the PUT legs of my strangles, and the same with Gold. For those of you new to the newsletter and this website for subscribers: I want to reiterate that anytime you allow profits in a trade and decide to hold the trade open, you are risking those (unrealized profits) when you keep the trade open in an effort to make even more. I have several articles discussing this at my blog: https://SellingCommodityOptions.com

Especially if you are a new reader: If you want a quick “Rule of Thumb” on the money management that I suggest you consider, please read the recent post here: https://sellingcommodityoptions.com/blog/option-trading-rules/

I will be posting some new articles on the https://SellingCommodityOptions.com blog on the topics of: SPAN Minimum Margins, What Things to Consider in An On-line Discount Futures & Options Broker. I will let you know here when these are posted.

And please remember, if you are ever trying to explain what we do here at Time Farming to a friend (and you get that ‘blank stare’), I have a free down-loadable PDF booklet that can explain it quickly: Seasonal Commodity Trading -Patterns for Profit at this link: http://bit.ly/PFProfit

Thanks – have a great week. -Don

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Corn: Even though I exited my 400 DEC18 corn CALLs, some of you may still be in that or a similar trade – so I’ll comment on it. The DEC18 Corn closed on Friday at 356.50 down -8.5 cents for the day and the 400-strike CALL is last traded at .875. Here’s what happened on Friday: The September 1st stocks report by USDA – was considered bearish with September 1st stocks coming in at 2.140 billion bushels versus the average estimate of 2.010 billion bushels (1.953-2.099 billion range) and compared to last year’s 2.293 billion bushels. To be clear: This is saying the stocks for this season 2017/18 Est. have been raised by 130 million bushels.

This means (see table 2.140 in RED ) the “Ending Stocks” for 2017-18 was raised by 6.5%. This resulted in the DEC18 Corn trading down to 356.50. Unless, the October 11th WASDE report lowers the expected yield, the record 181.3 bushels/acre, the Corn futures have probably made a high for the season.

Soybeans: About 30 million bushels were added to the the September 1st stocks report for soybeans was considered bearish with September 1st stocks coming in at 438 million bushels versus the average estimate of 398 million bushels and compared to last year’s 302 million bushels. The beginning stocks for the 2018-19 year came in well above expectations also. Some analyst believe, since Brazilian soybeans are now more than 25% higher than USA soybean prices, this could offer price support at least short-term for soybeans. This is by no means bullish and as harvest progresses this fall (Norther Hemisphere), prices could drift down more. The tariff status is of course a wild card, but it doesn’t look like any changes are in the immediate future.

Gold: As indicated on the most recent Trade Summary Sheet in the newsletter: I am short the DEC18 Gold 1400C/1050P strangle. This strangle expires on 11/27/2018, only 58 days away. Here’s the current chart:

I am also short an even “wider” FEB19 Gold 1500C/1000P strangle (not shown here), that expires in about 120 days on January 19, 2019. At present, I am very comfortable with both these short strangle positions. The FED indicated another raise in interest rates, which will continue strength in the $DXY / $US dollar Index. Should the stock market have a huge correction, it could drive gold prices up more as investors run for a ‘safe haven’ investment. There is always talk and speculation about these possibilities. All the short strikes I have sold are so far OTM (out-of-the-money), and all have such low Deltas, that I could get ‘out of the way’ if there is any drastic change in the present outlook. The chart (above) illustrates this point. At present, the 1400 CALL is over $200 OTM and the 1050 PUT is almost $150 OTM. The FEB19 strangles are even farther OTM (“wider”.)

Crude: I often mention my friends at OptionSellers.com They are very capable and smart money mangers and are sellers of commodity options for their clients. They handle money for large investors and their account minimum is $500,000. They do a spectacular job for their clients. They also have a great blog, and just last week posted what I think is a great article on the Crude Oil longer-term price outlook, making many salient points. The title of the article is: CRUDE OIL UPDATE: OPEC Headlines the Gift that Keeps on Giving to Call Sellers. I suggest you give this article a read, here’s the LINK.

As of late, Crude Oil futures have been on the rise, and still could go a little higher in the short-term. The prospects for the short DEC18 options looks to be ok for now. The “Prob. OTM”, the probability the option will expire OTM (Out-of-the-Money) remains high. With only 6 weeks to go, the odds are good for these trades. I should note here that the “Prob. OTM” statistic does NOT factor in a market’s fundamentals. The “Prob.OTM” is a Black-Scholes or similar derivation based on: volatility of the underlying contract, days until expiration, and how far OTM the strike is. I do not trade solely on this number, but it is, for me, a very important consideration.

Natural Gas: I am short the DEC18 NGZ18 3.750-strike. It is 91.88% Prob. OTM and expires in 58 days on 27NOV2018. I do not foresee at present this option reaching the strike. Here’s the chart as of 30SEP2018:

Here is the seasonal price pattern, the 15-year average for the DEC Natural Gas futures. I’ve posted it here before of course. Some traders refer to the drop off in NG prices between times of (Norther Hemisphere) hot weather of summer and the cold weather of winter as a “shoulder”, referring to the price pattern of this seasonal price retreat. I have a book with all the contract’s price 15 year patterns for 14 commodity markets. While it is a valuable tool to use in commodity trading, I would never trade armed with only the seasonal pattern info, I also want to follow a market’s seasonal fundamentals and be aware of tariffs, politics, conflicts, and many other factors that influence price. There are plenty of examples over the years of “counter seasonal price moves.” Sales and purchases of commodities in these markets can get “overdone” in either direction. So be aware that while these charts can be a great tool, it is just one of many items a trader must consider.

I’ve posted it here before of course. Some traders refer to the drop off in NG prices between times of (Norther Hemisphere) hot weather of summer and the cold weather of winter as a “shoulder”, referring to the price pattern of this seasonal price retreat. I have a book with all the contract’s price 15 year patterns for 14 commodity markets. While it is a valuable tool to use in commodity trading, I would never trade armed with only the seasonal pattern info, I also want to follow a market’s seasonal fundamentals and be aware of tariffs, politics, conflicts, and many other factors that influence price. There are plenty of examples over the years of “counter seasonal price moves.” Sales and purchases of commodities in these markets can get “overdone” in either direction. So be aware that while these charts can be a great tool, it is just one of many items a trader must consider.

The ICE markets and the Meats: I do a lot of my trading from the ThinkOrSwim(tm) platform by TD Ameritrade. While I enjoy the platform and the SPAN minimum margin requirements it provides, it does have some short-comings. For someone new to commodity trading, the list of all the markets looks daunting. There are far more than 50 different futures type contracts. While this is true, most of the trading in the commodity markets are done in less than a dozen markets: mostly corn, wheat, soybeans, silver, gold, crude oil, natural gas, RBOB (unleaded gas), cotton, coffee, and cocoa, live cattle, feeder cattle, and live hogs.

TOS (ThinkOrSwim) does not trade any futures or options of the category called the “softs,” these are (primarily) orange juice, cotton, coffee, and cocoa. TOS does not trade options on the meats: Live Cattle, Feeder Cattle, and Live Hogs. The softs are all traded on ICE (InterContinentalExchange) based in Atlanta, GA. CME, the Chicago Mercantile Exchange, is where the meats are traded.

Can a small trader do well while using only ThinkOrSwim? Certainly she/he can – and many small/medium traders do it all the time. This is just personal opinion, but I have to say that TD Ameritrade / ThinkOrSwim is fantastic. I’ve used them for years and they have one of the best customer service and support found anywhere in the world.

Personally, I like trading the following commodities NOT handled by TOS or many other brokers: silver, live cattle, feeder cattle, live hogs, coffee, and cotton. There are opportunities for commodity option sellers in these markets that should not be ignored (in my opinion.) I have personal accounts where I can trade some of these markets, but some of the brokers I use ( and have used) do NOT use SPAN minimum, and some of them require $25,000 minimum or higher account size to open.

I am currently- and have been for a few weeks, trying some demo programs that I can recommend for those who wish to trade ALL the markets in my list above while getting SPAN minimum, low commissions, and good customer service. Soon, probably within two weeks – will put comments here about them. Some are quite promising for small/medium investors. My list will not be comprehensive, as I don’t have time to try 40 different on-line brokers and comment on each one. I will merely pick out two or three that are, in my personal opinion, quite suitable and tell you about them. And I will list them on the page at this website at the tab Resource: Links Library.

One of the difficulties for small/medium investors is being able to trade the ICE softs futures. CBOT, CME, and almost all commodity markets have very low fees in order to receive live quotes. So low, that many brokers easily absorb those fees and give them to their customers free; others might charge $15 to $30 a month for all these many markets- and that seems a fair price, unlike those the ICE demands. The ICE is the single exception. ICE exchange charges EACH INDIVIDUAL INVESTOR around $1300 year to get live quotes on their futures that include: orange juice, cotton, coffee, and cocoa. Their policy is very unpopular for (I think) obvious reasons. For a large investor or institutional traders, and large corporate hedgers – their fee might seem relatively small.

There is a way that some brokers will allow their customers to trade ICE futures and options without LIVE quotes (the ones that cost $1300 a year to get.) They allow customers to receive delayed quotes; these quote are delayed up to :30 minutes. For the type of trading we do, this can work just fine. Why? Because we aren’t doing day-trading or trying to scalp some money off of quick in-and-out trades (that would definitely require live quotes.) I found there is a further complication ’caused’ by ICE’s policy; the ICE does NOT allow live or delayed quotes on any broker’s DEMO software. However, ICE will allow (free) quotes so long as they are delayed in actual accounts (just not he DEMO’s versions). This means you cannot paper-trade ICE futures in DEMO accounts, but once your account is active and funded, you can trade them using free delayed quotes. I hasten to add, this is done by many traders that just do not feel the type of trading they do requires the LIVE quotes, aka: real-time quotes.

I have, during the last year, listed trades in my newsletter on futures at the ICE, but have not done any lately. I feel I am missing some opportunities by not using those markets. I particularly think there are some great opportunities in the meats, coffee, and cotton. In coming weeks, I will be listing those in my trading. Whether you choose to use them or not, is entirely up to you. I feel it is quite possible to do very well without them. It is a personal choice. I am not suggesting you ditch your broker if they don’t allow trading ICE futures with or without the $1300 / year fees. I want to be clear about that. Most of my trades will continue to be NOT in the ICE futures. My hope is that one day, they will have a better policy on quote fees that will be more accommodating to small/med traders.

Having said all this, I will share my findings with you very soon – and I hope you will find them useful for your own application. I do not get paid by any broker or receive any compensation in any form from them. FYI: I am not a broker, nor a money-manager, nor do I want to be either. I am a writer and educator; the only products I sell are my books and newsletter.

Looking Forward to the week: Since Crude Oil has been going up, I may be able to take some profits in the PUT legs of my strangles, and the same with Gold. For those of you new to the newsletter and this website for subscribers: I want to reiterate that anytime you allow profits in a trade and decide to hold the trade open, you are risking those (unrealized profits) when you keep the trade open in an effort to make even more. I have several articles discussing this at my blog: https://SellingCommodityOptions.com

Especially if you are a new reader: If you want a quick “Rule of Thumb” on the money management that I suggest you consider, please read the recent post here: https://sellingcommodityoptions.com/blog/option-trading-rules/

I will be posting some new articles on the https://SellingCommodityOptions.com blog on the topics of: SPAN Minimum Margins, What Things to Consider in An On-line Discount Futures & Options Broker. I will let you know here when these are posted.

And please remember, if you are ever trying to explain what we do here at Time Farming to a friend (and you get that ‘blank stare’), I have a free down-loadable PDF booklet that can explain it quickly: Seasonal Commodity Trading -Patterns for Profit at this link: http://bit.ly/PFProfit

Thanks – have a great week. -Don

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.