24 September 2018 MONDAY

Corn: The USDA/WASDE report on September 12 reported a record yield per acre of 181.3 bushels for the US crop and ending stocks forecast at 1.774 billion bushels. This yield is 5 bushels/acre higher than last season. The WASDE report is a monthly report and the next one due in October 11, 2018. (Noon EST.) With such a large record yield, there is always a possibility that the USDA could revised that yield down some in the next report, which could result in the DEC18 Corn moving up. Since I am short the DEC18 $4.00 CALL, this is something I’m watching closely. Last season, the DEC17 corn contract ranged 344 to 362 in the month of September, and then the priced dropped off into the harvest afterwards. Here’s the chart for DEC17 Corn futures:

Now, here’s a look at the current (24SEP2018) Corn DEC18 contract price chart. You can see the contract HIGH peaked at about $4.29 /bushel:

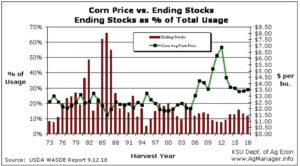

Kansas State University updated their charts with the most recent, September 2018 WASDE (World Supply – Demand Estimates) and here’s the Corn price (seasonal avg. projection) versus Ending Stocks-to-Use ratio (%).

Comments: If you are new to commodities, the contract specifications and the dates and names of contract can be a little daunting. One point of confusion sometimes is caused by the fact that the OPTION on a CONTACT MONTH, expires BEFORE the CONTRACT NAMED MONTH. Here is a glimpse of the free download I made with NOV2018 through OCT2019 option expiration dates. I put a link for this download on the tab: Resource: Links Library

You can download it directly by clicking this LINK now. This list includes: GRAINS – ENERGIES – MEATS- SOFTS – METALS.

There is also a free download at the Resource: Links Library for a list of common commodity contracts with the unit values, tick value and other information: Futures Ticker Symbols and Month Codes free download

Crude Oil and Gold: Some of the options out on Crude Oil and Gold have gone down in value since they were sold. If the opportunity comes up this week, I may take some profits there. As I am able to close these positions, I will immediately shop for more strikes and dates to sell.

Soon I will be putting up some links and articles on Coffee, Cotton, and Livestock futures. Once those resources are in place, I plan on shopping for options to sell in those markets. I will also start to put up fundamental information on these markets in new articles on my blog: https://SellingCommodityOptions.com I am also looking forward beyond DEC18 in Natural Gas for option selling opportunities in JAN19 class of options and farther out.

Losing Trades: Fortunately, these are few and far in between, but you must remember there will be some losses. What I emphasize is keeping the losses manageable. I mean relatively small. Occasional losses are a part of trading. Prepare yourself to be able to handle these. Not all trades work as we hope and things happen that cannot be predicted – things over which we have no control – so you must be mentally and emotionally prepared so you will have the discipline to protect your account when necessary. All traders have losing trades; we don’t like them, but you must realize that having a losing trade does NOT mean you have failed; it is just a part of trading. The https://SellingCommodityOptions.com blog has several articles that address this point. Some of our recently new subscribers may not have seen them, so the links to three of them are listed below.

Have a great week. – Don Singletary

Selling Commodity Options Five Rules for Success

How to Stop Loss in Trading

Trading Psychology & Selling Commodity Options

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

24 September 2018 MONDAY

Corn: The USDA/WASDE report on September 12 reported a record yield per acre of 181.3 bushels for the US crop and ending stocks forecast at 1.774 billion bushels. This yield is 5 bushels/acre higher than last season. The WASDE report is a monthly report and the next one due in October 11, 2018. (Noon EST.) With such a large record yield, there is always a possibility that the USDA could revised that yield down some in the next report, which could result in the DEC18 Corn moving up. Since I am short the DEC18 $4.00 CALL, this is something I’m watching closely. Last season, the DEC17 corn contract ranged 344 to 362 in the month of September, and then the priced dropped off into the harvest afterwards. Here’s the chart for DEC17 Corn futures:

Now, here’s a look at the current (24SEP2018) Corn DEC18 contract price chart. You can see the contract HIGH peaked at about $4.29 /bushel:

Kansas State University updated their charts with the most recent, September 2018 WASDE (World Supply – Demand Estimates) and here’s the Corn price (seasonal avg. projection) versus Ending Stocks-to-Use ratio (%).

Comments: If you are new to commodities, the contract specifications and the dates and names of contract can be a little daunting. One point of confusion sometimes is caused by the fact that the OPTION on a CONTACT MONTH, expires BEFORE the CONTRACT NAMED MONTH. Here is a glimpse of the free download I made with NOV2018 through OCT2019 option expiration dates. I put a link for this download on the tab: Resource: Links Library

You can download it directly by clicking this LINK now. This list includes: GRAINS – ENERGIES – MEATS- SOFTS – METALS.

There is also a free download at the Resource: Links Library for a list of common commodity contracts with the unit values, tick value and other information: Futures Ticker Symbols and Month Codes free download

Crude Oil and Gold: Some of the options out on Crude Oil and Gold have gone down in value since they were sold. If the opportunity comes up this week, I may take some profits there. As I am able to close these positions, I will immediately shop for more strikes and dates to sell.

Soon I will be putting up some links and articles on Coffee, Cotton, and Livestock futures. Once those resources are in place, I plan on shopping for options to sell in those markets. I will also start to put up fundamental information on these markets in new articles on my blog: https://SellingCommodityOptions.com I am also looking forward beyond DEC18 in Natural Gas for option selling opportunities in JAN19 class of options and farther out.

Losing Trades: Fortunately, these are few and far in between, but you must remember there will be some losses. What I emphasize is keeping the losses manageable. I mean relatively small. Occasional losses are a part of trading. Prepare yourself to be able to handle these. Not all trades work as we hope and things happen that cannot be predicted – things over which we have no control – so you must be mentally and emotionally prepared so you will have the discipline to protect your account when necessary. All traders have losing trades; we don’t like them, but you must realize that having a losing trade does NOT mean you have failed; it is just a part of trading. The https://SellingCommodityOptions.com blog has several articles that address this point. Some of our recently new subscribers may not have seen them, so the links to three of them are listed below.

Have a great week. – Don Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.