Crude Oil:

Remember all the news stories that suggested $US 100 a barrel oil was in the near future – barely two weeks ago? Well, the news chatter right now has become bearish. Featured economic stories now talk of a faltering Chinese economy, more interest rate hikes, possible inflationary trends, lower corporate earnings, tariff disputes, and possibly a huge (USA) stock market drop. If you want to learn about so-called “economic news,” just remember how many “experts” were expecting $100 a barrel oil only 15 days ago and now so many of the same commentators and financial news outlets hold the exact opposite view. The media news cycle seems to turn on a dime, and they maintain their credibility only because of the short memory of their audience.

Observing how fast sentiments can change, only makes me more glad that I am not an investor who must try to guess where prices will go. As a seller of commodity options, my fate is not synchronized with either a news cycle or the stock market performance. As commodity option sellers, our goal is to keep our strikes at prices (higher CALLs / or lower PUTs) than where prices are likely to go. This past week, per the newsletter issued on 24OCT2018: DOWNLOAD I closed my short 85 and 90-strike DEC18 CALLs with profits.

I am still short the DEC18 55 PUT option that expires in little more than two weeks from now on 14NOV2018. The DEC18 Crude Oil futures closed on Friday at: $67.62. Although I suspect Crude Oil prices might drop some in the next two weeks, I will watch this option play closely because I do not want to give the profits back — so I could get out of it quickly, or I might let it ride with only two weeks to go. If you hold this trade and are more conservative, you might be taking the profits on it now – and there is never anything “wrong” with taking the money and moving on to another trade. My short JAN19 Crude Oil 50-strike PUT and my short JAN19 Crude Oil 90-strike CALL are both at a profit, I will continue to hold these because I think the far OTM strikes of $50 and $90 are likely out of reach for oil prices over the next 47 days until expiry in six weeks on 14DEC2018.

I also continue to hold the APR19 Crude Oil short strangle: $50P/$100C for now. I am eager to find some more crude oil strikes to sell. I’ll be following the fundamentals of oil and will start shopping for strikes, both PUTs and CALLs to sell. I can’t say for sure that I’ll place those trades this week though.

It seems that the sanction “deadline date” (for compliance) placed on Iranian crude oil may come and go with not much impact on 6NOV2018. This suggests that whatever impact there might be, has already been factored into the market. The front news stories reporting some lower stock earnings, a possible faltering Chinese economy, and other weak-economy headlines have taken over as lead stories on oil demand, and they portend price weakness for oil in the short term. Just please remember how fast these media-generated notions can turn around.

Short Strangles

I want to make a short aside comment on short strangles here: If you are new to the Time Farming Newsletter and Commentary, you won’t know that I’ve held short strangles continuously during this calendar year on both Gold and Crude Oil. A huge advantage of short strangles is that the trader is short two strikes that cannot both be exercised at expiration. This results in a lower initial margin deposit that in turn, increases the ROI of a trade. Short strangles are a favorite strategy of mine. Please notice that I often make what could be called an “adjustment” of these trades. For example: (see Trade Summary sheet dates) On 6/20/2018 I placed the Gold short strangle DEC18 1700C/1050P. A month later I closed the 1700 CALL for a profit and sold the 1500 CALL on 7/16/2018, then again later on 8/23/2018, I took profits on the 1500C and sold a 1400 strike DEC18. During the time period between I first placed the trade from 6/20/18 until I placed the short 1400 CALL on 8/23/2018, Gold prices were going down. This process of taking a profit on one-side of a short strangle, and then immediately (or soon after) selling another strike is sometimes called “rolling.” In other words, I took some profit each time and sold another strike on one leg of a short strangle.

If you are new to option trading, I do realize that a great many new terms have to be learned – and this can be a bit daunting. My advice is to study some of these things as you go along. Do not feel you must learn everything at once. Studying operations like that above of “rolling one leg of a short strangle” are a good opportunity to increase your knowledge. As you learn techniques like this, it gives your brain a new vocabulary that allows you to operate in new dimensions of option strategy. The actual concepts are really not complicated; what makes it seem so is that you have to learn the new terms to go with them. So you could say you are learning “option-speak.” Remember: You will be rewarded nicely for your efforts. Don’t try to learn it all too fast, better to digest a few new terms and concepts at a time. The best and easiest way to learn things is to actually DO them. The very best way to learn options is to use a paper-money account; this also allows you to use your trading software at the same time. If for any reason, you can’t use a paper-money account, then start a notebook journal and keep notes on practice trades until you gain confidence.

Gold: There are two opposing forces at work on Gold prices now. With the stock market volatility rising and this market having huge down days, there is a tendency for many investors to put money into gold. When seeing Gold prices rise as confidence in the stock market fades, the money moved to invest in Gold from the stock market is called the “safe haven” effect. At present, the $US dollar is poised to rise. When/if there are more interest rate increases, the $US dollar (historically) strengthens. Usually, as the $US dollar strengthens, Gold prices will drop. This chart below illustrates this (somewhat inverse) relationship between $US versus Gold. Purist will argue that over the last 80 years, there has been “on the average” no such relationship. In your trading watch-list put in $DXY and /GCG19 and you decide for yourself. There is also an article I wrote on this at my blog at: Selling Commodity Options

What I meant by “two opposing forces” on Gold prices is: 1) safe haven effect, and 2) Gold’s inverse relationship with $US dollar. All things considered, it seems the odds of Gold prices going up over the long-term (6 months to a year out) might outweigh the odds of Gold prices going down. If I were to put this into practice, which I have not yet, I might look more at selling gold PUTS than CALLs. This might come into play during calendar 2019.

Soybeans:

I just placed a new article on the Selling Commodity Options Blog about an opportunity for selling soybean CALLs. Please read this article before reading the comments below. The article is posted here: LINK or https://sellingcommodityoptions.com/blog/soybean-call-option-profit-opportunity/

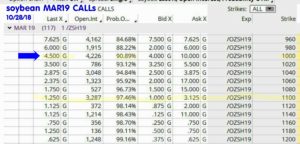

My comments on selling Soybean CALLs: I am assuming you read the article LINK. I will follow it now with these comments: So let’s open up the MAR19 class option matrix and go shopping:

The underlying MAR19 Soybean futures closed Friday at $8.71 /bushel (871 cents.) Look at the MAR19 CALLs in the table above (this is in the TOS software.) The Last Trade (Last X) was 4.5 cents (4.5 x $50) = $225. The BP Effect (net initial margin) to trade is $578.25. These options expire in 116 days on 21FEB2019.

source: Option Expiration Dates List DOWNLOAD

I will likely sell the 1000 ($10/bushel) strikes very soon. A more conservative trader might prefer to sell a slightly higher strike between 1000 through 1100; this would be less risky – as you can see by the “Prob OTM” stat on the matrix. (Prob OTM = math probability this options expires Out-of-the-Money.) Sometimes a trader might choose to sell more options farther OTM than an option nearer the money. The 1100 strike has BP effect of $260 and the premium is $50; this is still an ROI (50/260 = .192) 19.2% in just less than four months, an annualized return of 57.6%. Not shabby at all. Remember an annualized ROI is based on initial margin, more margin can be required if/when the trade has a drawdown – and that would greatly reduce the ROI. Don’t be lured into complacency by the ROI numbers on these option sales. Play it safe and don’t get greedy. Balance is the key.

There is something about soybean fundamentals you need to keep in mind. Presently, China is doing everything it can not to buy soybeans from the United States of America. The two largest sellers of soybeans to China are the USA and Brazil. The USA soybean harvest is underway now. The Southern hemisphere crop in Brazil begins harvest in Jan19. It is a widely held belief that China will buy as many soybeans as it can from Brazil. For that reason limited USA sales are projected; this is all happening (remember the article chart on soybean production) at a time when soybeans were in abundance even before these tariff disputes began. The MAR19 options expire in FEB19; the Brazilian harvest will be in progress. This means good conditions for Brazil crops will be very bearish for USA soybeans. All this discussion so far has been about the time frame between now and mid FEB19. Over the longer-term, more countries including Brazil will plant more soybeans to make up for the stoppage of USA soybean exports to China (by far USA’s largest customer.) The fear is that over the next two years, if the tariff disputes continue, that the China market for soybeans produced by the USA will almost entirely disappear and it will be difficult to impossible to win that market share back. USA farmers make huge money from soybeans and growing soybeans is less cash-intensive for USA farmers than growing corn. Corn prices will likely be higher next year than this season, meaning USA farmers who realize they can’t sell soybeans except for very low prices, will probably allot more acres to corn growing in 2018/2019. All of these consideration are factors I have considered in deciding to sell the MAR19 soybean CALLs.

Corn:

Last week I mentioned I might be selling Corn PUTs on option classes in the first half of calendar 2019, that would be the JAN, MAR, MAY, and JUL options. There is a bullish bias for price of corn in 2019 as ending stocks are very likely to come in lower, at a time when corn for ethanol production (the E-15 initiative) will be in demand. I hope to be selling far OTM calls on Corn in the second half of calendar 2019. IF there is a huge increase in USA corn planting acreage next year, there will be good opportunities for this. For now, I am trying to time the selling of corn PUTs in the first half of the year. The corn harvest is rapidly underway, and was stalled by rains in the USA, which could have been the reason prices bounced up on Friday. The DEC18 corn futures closed at 368.50, up 7.50 cents and made up for most of the week’s downside price movement. Here (below) is the 15-year average seasonal price pattern for MAR Corn futures (the percentage of low to high prices.)

That’s all for now. Good trading to everyone.

If you are on the free trial, please check to see when your trial expires, so you won’t miss any issues if you plan to continue. Thank you. -Don

I welcome your comments. My email address is Don@WriteThisDown.com

If you are new, please check out the many articles at my blog: SellingCommodityOptions.com

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Crude Oil:

Remember all the news stories that suggested $US 100 a barrel oil was in the near future – barely two weeks ago? Well, the news chatter right now has become bearish. Featured economic stories now talk of a faltering Chinese economy, more interest rate hikes, possible inflationary trends, lower corporate earnings, tariff disputes, and possibly a huge (USA) stock market drop. If you want to learn about so-called “economic news,” just remember how many “experts” were expecting $100 a barrel oil only 15 days ago and now so many of the same commentators and financial news outlets hold the exact opposite view. The media news cycle seems to turn on a dime, and they maintain their credibility only because of the short memory of their audience.

Observing how fast sentiments can change, only makes me more glad that I am not an investor who must try to guess where prices will go. As a seller of commodity options, my fate is not synchronized with either a news cycle or the stock market performance. As commodity option sellers, our goal is to keep our strikes at prices (higher CALLs / or lower PUTs) than where prices are likely to go. This past week, per the newsletter issued on 24OCT2018: DOWNLOAD I closed my short 85 and 90-strike DEC18 CALLs with profits.

I am still short the DEC18 55 PUT option that expires in little more than two weeks from now on 14NOV2018. The DEC18 Crude Oil futures closed on Friday at: $67.62. Although I suspect Crude Oil prices might drop some in the next two weeks, I will watch this option play closely because I do not want to give the profits back — so I could get out of it quickly, or I might let it ride with only two weeks to go. If you hold this trade and are more conservative, you might be taking the profits on it now – and there is never anything “wrong” with taking the money and moving on to another trade. My short JAN19 Crude Oil 50-strike PUT and my short JAN19 Crude Oil 90-strike CALL are both at a profit, I will continue to hold these because I think the far OTM strikes of $50 and $90 are likely out of reach for oil prices over the next 47 days until expiry in six weeks on 14DEC2018.

I also continue to hold the APR19 Crude Oil short strangle: $50P/$100C for now. I am eager to find some more crude oil strikes to sell. I’ll be following the fundamentals of oil and will start shopping for strikes, both PUTs and CALLs to sell. I can’t say for sure that I’ll place those trades this week though.

It seems that the sanction “deadline date” (for compliance) placed on Iranian crude oil may come and go with not much impact on 6NOV2018. This suggests that whatever impact there might be, has already been factored into the market. The front news stories reporting some lower stock earnings, a possible faltering Chinese economy, and other weak-economy headlines have taken over as lead stories on oil demand, and they portend price weakness for oil in the short term. Just please remember how fast these media-generated notions can turn around.

Short Strangles

I want to make a short aside comment on short strangles here: If you are new to the Time Farming Newsletter and Commentary, you won’t know that I’ve held short strangles continuously during this calendar year on both Gold and Crude Oil. A huge advantage of short strangles is that the trader is short two strikes that cannot both be exercised at expiration. This results in a lower initial margin deposit that in turn, increases the ROI of a trade. Short strangles are a favorite strategy of mine. Please notice that I often make what could be called an “adjustment” of these trades. For example: (see Trade Summary sheet dates) On 6/20/2018 I placed the Gold short strangle DEC18 1700C/1050P. A month later I closed the 1700 CALL for a profit and sold the 1500 CALL on 7/16/2018, then again later on 8/23/2018, I took profits on the 1500C and sold a 1400 strike DEC18. During the time period between I first placed the trade from 6/20/18 until I placed the short 1400 CALL on 8/23/2018, Gold prices were going down. This process of taking a profit on one-side of a short strangle, and then immediately (or soon after) selling another strike is sometimes called “rolling.” In other words, I took some profit each time and sold another strike on one leg of a short strangle.

If you are new to option trading, I do realize that a great many new terms have to be learned – and this can be a bit daunting. My advice is to study some of these things as you go along. Do not feel you must learn everything at once. Studying operations like that above of “rolling one leg of a short strangle” are a good opportunity to increase your knowledge. As you learn techniques like this, it gives your brain a new vocabulary that allows you to operate in new dimensions of option strategy. The actual concepts are really not complicated; what makes it seem so is that you have to learn the new terms to go with them. So you could say you are learning “option-speak.” Remember: You will be rewarded nicely for your efforts. Don’t try to learn it all too fast, better to digest a few new terms and concepts at a time. The best and easiest way to learn things is to actually DO them. The very best way to learn options is to use a paper-money account; this also allows you to use your trading software at the same time. If for any reason, you can’t use a paper-money account, then start a notebook journal and keep notes on practice trades until you gain confidence.

Gold: There are two opposing forces at work on Gold prices now. With the stock market volatility rising and this market having huge down days, there is a tendency for many investors to put money into gold. When seeing Gold prices rise as confidence in the stock market fades, the money moved to invest in Gold from the stock market is called the “safe haven” effect. At present, the $US dollar is poised to rise. When/if there are more interest rate increases, the $US dollar (historically) strengthens. Usually, as the $US dollar strengthens, Gold prices will drop. This chart below illustrates this (somewhat inverse) relationship between $US versus Gold. Purist will argue that over the last 80 years, there has been “on the average” no such relationship. In your trading watch-list put in $DXY and /GCG19 and you decide for yourself. There is also an article I wrote on this at my blog at: Selling Commodity Options

What I meant by “two opposing forces” on Gold prices is: 1) safe haven effect, and 2) Gold’s inverse relationship with $US dollar. All things considered, it seems the odds of Gold prices going up over the long-term (6 months to a year out) might outweigh the odds of Gold prices going down. If I were to put this into practice, which I have not yet, I might look more at selling gold PUTS than CALLs. This might come into play during calendar 2019.

Soybeans:

I just placed a new article on the Selling Commodity Options Blog about an opportunity for selling soybean CALLs. Please read this article before reading the comments below. The article is posted here: LINK or https://sellingcommodityoptions.com/blog/soybean-call-option-profit-opportunity/

My comments on selling Soybean CALLs: I am assuming you read the article LINK. I will follow it now with these comments: So let’s open up the MAR19 class option matrix and go shopping:

The underlying MAR19 Soybean futures closed Friday at $8.71 /bushel (871 cents.) Look at the MAR19 CALLs in the table above (this is in the TOS software.) The Last Trade (Last X) was 4.5 cents (4.5 x $50) = $225. The BP Effect (net initial margin) to trade is $578.25. These options expire in 116 days on 21FEB2019.

source: Option Expiration Dates List DOWNLOAD

I will likely sell the 1000 ($10/bushel) strikes very soon. A more conservative trader might prefer to sell a slightly higher strike between 1000 through 1100; this would be less risky – as you can see by the “Prob OTM” stat on the matrix. (Prob OTM = math probability this options expires Out-of-the-Money.) Sometimes a trader might choose to sell more options farther OTM than an option nearer the money. The 1100 strike has BP effect of $260 and the premium is $50; this is still an ROI (50/260 = .192) 19.2% in just less than four months, an annualized return of 57.6%. Not shabby at all. Remember an annualized ROI is based on initial margin, more margin can be required if/when the trade has a drawdown – and that would greatly reduce the ROI. Don’t be lured into complacency by the ROI numbers on these option sales. Play it safe and don’t get greedy. Balance is the key.

There is something about soybean fundamentals you need to keep in mind. Presently, China is doing everything it can not to buy soybeans from the United States of America. The two largest sellers of soybeans to China are the USA and Brazil. The USA soybean harvest is underway now. The Southern hemisphere crop in Brazil begins harvest in Jan19. It is a widely held belief that China will buy as many soybeans as it can from Brazil. For that reason limited USA sales are projected; this is all happening (remember the article chart on soybean production) at a time when soybeans were in abundance even before these tariff disputes began. The MAR19 options expire in FEB19; the Brazilian harvest will be in progress. This means good conditions for Brazil crops will be very bearish for USA soybeans. All this discussion so far has been about the time frame between now and mid FEB19. Over the longer-term, more countries including Brazil will plant more soybeans to make up for the stoppage of USA soybean exports to China (by far USA’s largest customer.) The fear is that over the next two years, if the tariff disputes continue, that the China market for soybeans produced by the USA will almost entirely disappear and it will be difficult to impossible to win that market share back. USA farmers make huge money from soybeans and growing soybeans is less cash-intensive for USA farmers than growing corn. Corn prices will likely be higher next year than this season, meaning USA farmers who realize they can’t sell soybeans except for very low prices, will probably allot more acres to corn growing in 2018/2019. All of these consideration are factors I have considered in deciding to sell the MAR19 soybean CALLs.

Corn:

Last week I mentioned I might be selling Corn PUTs on option classes in the first half of calendar 2019, that would be the JAN, MAR, MAY, and JUL options. There is a bullish bias for price of corn in 2019 as ending stocks are very likely to come in lower, at a time when corn for ethanol production (the E-15 initiative) will be in demand. I hope to be selling far OTM calls on Corn in the second half of calendar 2019. IF there is a huge increase in USA corn planting acreage next year, there will be good opportunities for this. For now, I am trying to time the selling of corn PUTs in the first half of the year. The corn harvest is rapidly underway, and was stalled by rains in the USA, which could have been the reason prices bounced up on Friday. The DEC18 corn futures closed at 368.50, up 7.50 cents and made up for most of the week’s downside price movement. Here (below) is the 15-year average seasonal price pattern for MAR Corn futures (the percentage of low to high prices.)

That’s all for now. Good trading to everyone.

If you are on the free trial, please check to see when your trial expires, so you won’t miss any issues if you plan to continue. Thank you. -Don

I welcome your comments. My email address is Don@WriteThisDown.com

If you are new, please check out the many articles at my blog: SellingCommodityOptions.com

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.