Greetings: TUESDAY 17 MARCH 2020

There are no trades this week. I am still short the JUN20 Crude Oil 60 CALL that is trading at 0.06 this morning. It was sold on FEB 11, 2020 for 0.31 ($310).

Commentary: I waited to post this newsletter today until after the midday appearance on TV of President Trump and his advisory team. You will see details in news reports, so no need to put them here.

In response to millions of Americans being out of work and other developments virus-related, the USA Government will be selectively mailing out checks perhaps of $1,000 or more to selected groups – and probably within two week from now, which is very quickly. Many other developments were announced today.

Gold prices which have fallen from over $1700 per ounce back down to well below $1500 ( APR20) AND today, futures trading $1527, up by $40 an ounce this morning.

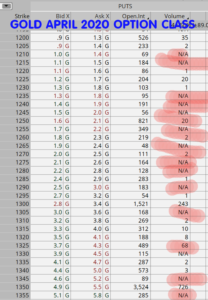

One might think, that with the unprecedented bearish stock market action, that Gold prices (‘the flight to safety) would go UP, or at least not go DOWN over the next few months. If this is a valid view, then selling PUTS could be a strategy. But look at the option matrix for the April 2020 Gold futures PUTS:

In the April 2020 option class matrix above, that shows APR20 class PUTs between $1200 to about $1350, the premiums are really high but this is one of those “looks too good to be true” propositions. There are ‘red flags’ all over the place. The abnormally high premiums, the extraordinary LOW open interest and almost NO Volume —- these are all what I call “danger signs” for any trading of them at all.

I checked through Gold, Oil, Grains, and more today and the option matrix of most of them contain many scenarios similar to the gold one I posted here. Our nation and the world are in ‘new territory’ with huge volatility everywhere in virtually all markets. I am almost certain to close the one (Crude) position I have out very soon (for a profit while I can) and to stand aside a while longer.

While I remain a strong proponent of the selling options strategies, the timing of this strategy is not good right now. Option sellers want boring trending markets and predictable seasonal patterns; none of those are available in any abundance right now.

Will there be more opportunities in the short-terms (2 to 3 months)? I suspect so and they could be some of the best we’ve ever seen. In fact, once the “light at the end of the tunnel” is seen on this virus pandemic, there will likely be more opportunities and larger profits that has been available in years for option sellers. That time is just NOT NOW.

Since I am unable to bring you, my subscribers, the best trading opportunities available that you deserve — I am suspending all membership payment collections effective at midnight tonight. Until further notice, EVERYONES membership will be extended without any new charges at all. My weekly post will continue as usual.

I will be posting trades during this time, perhaps with cautionary advice to go with them. This blog will continue as usual except payment collections will be lifted for a while to come. The seasonal highs for grains (in Northern Hemisphere) are coming this spring and summer, many of the markets with ‘distorted’ prices due to Covid-19 will be self-correcting as we get through this pandemic and there will be many SAFE opportunities to get back to Option-Selling.

Please expect the normal Tuesday newsletter and commentary; it will be posted as usual. I expect to be posting some videos here on the blog to discuss commodity prices and how markets are shaping new price ranges, so we all can be ready to trade at the appropriate time later this Spring and Summer. I can’t say what, if any trades, I might be placing in the next 4 to 10 weeks – simply because none of know what is coming next. So please keep reading and checking the blog here when I send out notifications via email when I post. I think the information we learn over the next few weeks will give us all a head start when developments and prices offer us some good trading over the remainder of this year.

All of you on our trial offers are included as well as regular subscribers. I am going to disable all payments at midnight tonight for subscriptions, and this web site will not make any additional charges for subscribers until further notice. Please know, that my service continues as usual. Since there may be only a very few trades for a while, due to circumstances beyond anyone’s control, I am not going to charge any fees until further notice.

Thank you. As usual, I could be posting on any day. My regular scheduled posting is on Tuesday of each week and that continues per usual. – Don

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Greetings: TUESDAY 17 MARCH 2020

There are no trades this week. I am still short the JUN20 Crude Oil 60 CALL that is trading at 0.06 this morning. It was sold on FEB 11, 2020 for 0.31 ($310).

Commentary: I waited to post this newsletter today until after the midday appearance on TV of President Trump and his advisory team. You will see details in news reports, so no need to put them here.

In response to millions of Americans being out of work and other developments virus-related, the USA Government will be selectively mailing out checks perhaps of $1,000 or more to selected groups – and probably within two week from now, which is very quickly. Many other developments were announced today.

Gold prices which have fallen from over $1700 per ounce back down to well below $1500 ( APR20) AND today, futures trading $1527, up by $40 an ounce this morning.

One might think, that with the unprecedented bearish stock market action, that Gold prices (‘the flight to safety) would go UP, or at least not go DOWN over the next few months. If this is a valid view, then selling PUTS could be a strategy. But look at the option matrix for the April 2020 Gold futures PUTS:

In the April 2020 option class matrix above, that shows APR20 class PUTs between $1200 to about $1350, the premiums are really high but this is one of those “looks too good to be true” propositions. There are ‘red flags’ all over the place. The abnormally high premiums, the extraordinary LOW open interest and almost NO Volume —- these are all what I call “danger signs” for any trading of them at all.

I checked through Gold, Oil, Grains, and more today and the option matrix of most of them contain many scenarios similar to the gold one I posted here. Our nation and the world are in ‘new territory’ with huge volatility everywhere in virtually all markets. I am almost certain to close the one (Crude) position I have out very soon (for a profit while I can) and to stand aside a while longer.

While I remain a strong proponent of the selling options strategies, the timing of this strategy is not good right now. Option sellers want boring trending markets and predictable seasonal patterns; none of those are available in any abundance right now.

Will there be more opportunities in the short-terms (2 to 3 months)? I suspect so and they could be some of the best we’ve ever seen. In fact, once the “light at the end of the tunnel” is seen on this virus pandemic, there will likely be more opportunities and larger profits that has been available in years for option sellers. That time is just NOT NOW.

Since I am unable to bring you, my subscribers, the best trading opportunities available that you deserve — I am suspending all membership payment collections effective at midnight tonight. Until further notice, EVERYONES membership will be extended without any new charges at all. My weekly post will continue as usual.

I will be posting trades during this time, perhaps with cautionary advice to go with them. This blog will continue as usual except payment collections will be lifted for a while to come. The seasonal highs for grains (in Northern Hemisphere) are coming this spring and summer, many of the markets with ‘distorted’ prices due to Covid-19 will be self-correcting as we get through this pandemic and there will be many SAFE opportunities to get back to Option-Selling.

Please expect the normal Tuesday newsletter and commentary; it will be posted as usual. I expect to be posting some videos here on the blog to discuss commodity prices and how markets are shaping new price ranges, so we all can be ready to trade at the appropriate time later this Spring and Summer. I can’t say what, if any trades, I might be placing in the next 4 to 10 weeks – simply because none of know what is coming next. So please keep reading and checking the blog here when I send out notifications via email when I post. I think the information we learn over the next few weeks will give us all a head start when developments and prices offer us some good trading over the remainder of this year.

All of you on our trial offers are included as well as regular subscribers. I am going to disable all payments at midnight tonight for subscriptions, and this web site will not make any additional charges for subscribers until further notice. Please know, that my service continues as usual. Since there may be only a very few trades for a while, due to circumstances beyond anyone’s control, I am not going to charge any fees until further notice.

Thank you. As usual, I could be posting on any day. My regular scheduled posting is on Tuesday of each week and that continues per usual. – Don

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.