Greetings: TUESDAY 10 MARCH 2020

Closing Trade: I made a closing purchase of the short 37-strike MAY20 PUT (corrected) for 0.65 for a loss of $500. This option was sold back on 11th FEB 2020 for 0.15 ($150.)

Last week (3/3/2020) I sold the JUN20 60-strike CALL @ 0.31. I still hold this short CALL and it is trading for 0.12 today with an unrealized profit of 0.19 ($190). This option expires on 5th of MAY 2020 65 days out.

Obviously, these are precarious times in all the markets right now. A week ago, I thought $37 Crude was extremely unlikely – and I was so wrong about that. Crude actually brushed $30 at one point. Things change in an instant. For now, the uncertainty is palpable with financial packages being planned to help the USA wage earners that will be very expensive- and it will no doubt put more uncertainty into an already complex situation.

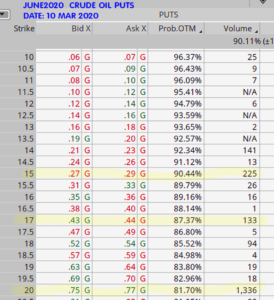

FYI: This is amazing: This illustration (below) is the JUNE 2020 class of PUT Options for Crude Oil:

The $10-strike PUT is $60

The $15-strike PUT is $25

and the $20-strike PUT is $760.

I hasten to add that the VOLUME and OI is very low, so low that it might not be possible to trade them if one wanted to.

I’m sure some speculators may have BOUGHT them very cheaply recently, and have probably done well. Hard to get my head around a price of $760 to BUY a JUN2020 $20-strike Crude Oil PUT. I am NOT suggesting anyone buy or sell these due to liquidity problems with extremely low open interests and volume. It’s just amazing to see these things. Makes me remember the old adage: If things look “to good to be true, they usually are.”

Another old adage: Sometimes the best trade is NO Trade. That time might be now.

For today, I have no new trades. There are just too many unknowns. There is no need for me to try and list them; they are all over the channels and newspapers. Like you, I’ll be following it all closely. – Thank you. – Don

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Greetings: TUESDAY 10 MARCH 2020

Closing Trade: I made a closing purchase of the short 37-strike MAY20 PUT (corrected) for 0.65 for a loss of $500. This option was sold back on 11th FEB 2020 for 0.15 ($150.)

Last week (3/3/2020) I sold the JUN20 60-strike CALL @ 0.31. I still hold this short CALL and it is trading for 0.12 today with an unrealized profit of 0.19 ($190). This option expires on 5th of MAY 2020 65 days out.

Obviously, these are precarious times in all the markets right now. A week ago, I thought $37 Crude was extremely unlikely – and I was so wrong about that. Crude actually brushed $30 at one point. Things change in an instant. For now, the uncertainty is palpable with financial packages being planned to help the USA wage earners that will be very expensive- and it will no doubt put more uncertainty into an already complex situation.

FYI: This is amazing: This illustration (below) is the JUNE 2020 class of PUT Options for Crude Oil:

The $10-strike PUT is $60

The $15-strike PUT is $25

and the $20-strike PUT is $760.

I hasten to add that the VOLUME and OI is very low, so low that it might not be possible to trade them if one wanted to.

I’m sure some speculators may have BOUGHT them very cheaply recently, and have probably done well. Hard to get my head around a price of $760 to BUY a JUN2020 $20-strike Crude Oil PUT. I am NOT suggesting anyone buy or sell these due to liquidity problems with extremely low open interests and volume. It’s just amazing to see these things. Makes me remember the old adage: If things look “to good to be true, they usually are.”

Another old adage: Sometimes the best trade is NO Trade. That time might be now.

For today, I have no new trades. There are just too many unknowns. There is no need for me to try and list them; they are all over the channels and newspapers. Like you, I’ll be following it all closely. – Thank you. – Don

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.