New Trial Subscribers: Due to the slow activity during the holidays, your free trials will be extended through January 31, 2020.

Greetings: TUESDAY 14 JAN 2020:

Closing Trades Today:

- I sold the 1800-strike MAR2020 Gold CALL for 1.40 ($140) last week on 7th JAN; Gold (APRIL FUTURES) was trading about $1597. It had spiked due to the Mid East conflict. I bought it back this morning – the MAR20 1800 CALL, a closing purchase at 0.30 ($30) for a profit of (140 – 30) = +$90 profit per option. This morning the GCJ20 (April Gold Futures) is trading at $1549. note: the underlying futures is APRIL even though the option class is MAR.

- Back on 10th DEC, I sold the Crude Oil MAR2020 strangle, the 70C/45P for total of .28 ($280). I closed out the 45 PUT for a profit (see last week post on 7th JAN 2020). Today, I closed out the 70-strike MAR20 CALLs with a closing purchase at a price of 0.06. I had sold it for 0.14, so ($140 minus $60) = profit of $80 each.

Corn: I continue to hold my MAR20 short 365-strike PUT. The underlying trading at 388.75 this morning and this option is trading bid/ask at: .875 / 1.000 ($43.75/$50). I sold 17 DEC2019 at 2.125 ($106.25.)

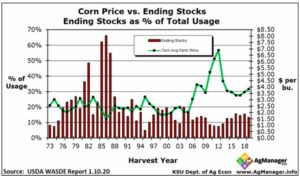

Comment on Corn position: The WASDE report last Friday did post a reduction in inventory; there was an unexpected readjustment for the ‘ending stocks’ on the 2018/2019 crop and an increase in expected shipments for the 2019/2020 crop – which resulted in a net increase in inventory. You can read the report at this link:

https://www.usda.gov/oce/commodity/wasde/

And here is the Kansas State University Supply-Demand/ Price chart with the JAN2020 numbers updated:

source: Kansas State Ag Dept website HERE

BTW, this KSU site is excellent for grain research and commentary (and it’s free.)

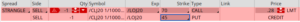

Comment on Crude Oil: Closing the Crude 70-strike MAR20 CALL today has me out of crude oil trades for now. I am currently shopping to sell more strangles in the APR, MAY, JUN and will have information on that to post here soon. If you want some practice, price each of those classes (APR, MAY, JUN) and use the strikes I still like for that time period of 70 CALLs and 45 PUTs. Here’s a look at the APR20 70C/45P short strangle:

The margin requirement for this trade is about $1250 and the credit (.28) is $280, so the potential return (assuming no draw down) would be 280/1250 = about 22.4% and the APR20 class of options expire in 63 days from today. The Prob OTM (probability of the options expiring worthless) is about 94%. Of course, as we remember from so recently – we are always just a few bombs in the Mideast away from a very risky trade. That 94% Prob. OTM is just the math from standard deviation computations and does not consider war, conflict, natural disasters, politics, and stock market movements. It is important that you understand such things as a 22% return in 63 days doesn’t come without some risk. If you can believe that whatever might happen would blow over as fast as this last threat, then a trade like this could be a consideration.

Look on this sites Resources pages for links to EIA (US Government site for Energy complex.) There are also links there for Ag TV, option expiration table, training videos on selling commodity options and more.

Comments: Another possibility, I always watch is for the stock market to have a (shall we say) a “deep correction” day or two, the price of Gold will pop up again and present opportunities to sell CALLS far above the money at increased rates of volatility – as what happened recently with the 1800-strike Gold CALL.

It is also time to start examining the grain options for this Spring. I’ll be discussing some of that very soon also. So for early 2020, we have Crude, Oil, Gold, Grains and maybe more. I often get asked why I don’t also trade Silver options; my answer is simple. If Gold weren’t there, I would be trading Silver options. I trade the Gold instead of both because the liquidity, open interest, and daily volume of Gold has more efficient pricing than that of Silver. Silver and Gold move very sympathetically, so it isn’t like trading one over the other has any real advantage (IMHO.)

The Phase One China deal in the news this week. Should something happen to thwart an agreement, this could move some futures prices unexpectedly and provide some opportunity. Even though the news will have good, great, and bad, reports on the agreement’s phase one (depending on one’s politics and view I suppose), any disruption of an immediate agreement would be a surprise (but maybe not a huge one!)

That’s it today. Have a great week. – Don

Have any interest in day trading the new Micro E-mini stock index futures? If so, please consider my new book on the subject available on Amazon: (read more at this link)

NEW: I have a new YouTube Channel devoted entirely to Day Trading the new Micro E-Minis. These new contracts were just introduced by CME in MAY 2019.

They trade in very low $5 and $2 per point increments and therefore provide a very low risk way to learn to day trade the stock indexes. They offer a fun way to make a few bucks and the commissions are about $1 per trade (per side) and the margins are 1/10th of the E-Mini contracts. Check’em out: Here’s the link to the new channel if you’d like to take a peek: LINK

Click on the book’s below for more info about them. Thank you.

I do a lot of my own trading with TastyWorks because I like the easy-to-use platform and they have lower commissions than most. The customer service is outstanding. I have an affiliate link and recommend them often for months now and I’ve never had any negative feedback. They also have excellent free mobile apps that are easy to use- and they have ACH free money transfers to-and-from you bank account (usually one day free service.) TastyWorks has just joined Schwab, ThinkOrSwim, and other brokers and introduced NO Commission stock trading.

TastyWorks: $2,000 minimum to open account. Easy online application, free ACH money transfers.

Read more about TastyWorks at this link please: http://daytradingmicros.com/brokers/

***************

***************

TastyWorks also has commissions on the new Micro e-Mini futures at only 85 cents.

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

New Trial Subscribers: Due to the slow activity during the holidays, your free trials will be extended through January 31, 2020.

Greetings: TUESDAY 14 JAN 2020:

Closing Trades Today:

Corn: I continue to hold my MAR20 short 365-strike PUT. The underlying trading at 388.75 this morning and this option is trading bid/ask at: .875 / 1.000 ($43.75/$50). I sold 17 DEC2019 at 2.125 ($106.25.)

Comment on Corn position: The WASDE report last Friday did post a reduction in inventory; there was an unexpected readjustment for the ‘ending stocks’ on the 2018/2019 crop and an increase in expected shipments for the 2019/2020 crop – which resulted in a net increase in inventory. You can read the report at this link:

https://www.usda.gov/oce/commodity/wasde/

And here is the Kansas State University Supply-Demand/ Price chart with the JAN2020 numbers updated:

source: Kansas State Ag Dept website HERE

BTW, this KSU site is excellent for grain research and commentary (and it’s free.)

Comment on Crude Oil: Closing the Crude 70-strike MAR20 CALL today has me out of crude oil trades for now. I am currently shopping to sell more strangles in the APR, MAY, JUN and will have information on that to post here soon. If you want some practice, price each of those classes (APR, MAY, JUN) and use the strikes I still like for that time period of 70 CALLs and 45 PUTs. Here’s a look at the APR20 70C/45P short strangle:

The margin requirement for this trade is about $1250 and the credit (.28) is $280, so the potential return (assuming no draw down) would be 280/1250 = about 22.4% and the APR20 class of options expire in 63 days from today. The Prob OTM (probability of the options expiring worthless) is about 94%. Of course, as we remember from so recently – we are always just a few bombs in the Mideast away from a very risky trade. That 94% Prob. OTM is just the math from standard deviation computations and does not consider war, conflict, natural disasters, politics, and stock market movements. It is important that you understand such things as a 22% return in 63 days doesn’t come without some risk. If you can believe that whatever might happen would blow over as fast as this last threat, then a trade like this could be a consideration.

Look on this sites Resources pages for links to EIA (US Government site for Energy complex.) There are also links there for Ag TV, option expiration table, training videos on selling commodity options and more.

Comments: Another possibility, I always watch is for the stock market to have a (shall we say) a “deep correction” day or two, the price of Gold will pop up again and present opportunities to sell CALLS far above the money at increased rates of volatility – as what happened recently with the 1800-strike Gold CALL.

It is also time to start examining the grain options for this Spring. I’ll be discussing some of that very soon also. So for early 2020, we have Crude, Oil, Gold, Grains and maybe more. I often get asked why I don’t also trade Silver options; my answer is simple. If Gold weren’t there, I would be trading Silver options. I trade the Gold instead of both because the liquidity, open interest, and daily volume of Gold has more efficient pricing than that of Silver. Silver and Gold move very sympathetically, so it isn’t like trading one over the other has any real advantage (IMHO.)

The Phase One China deal in the news this week. Should something happen to thwart an agreement, this could move some futures prices unexpectedly and provide some opportunity. Even though the news will have good, great, and bad, reports on the agreement’s phase one (depending on one’s politics and view I suppose), any disruption of an immediate agreement would be a surprise (but maybe not a huge one!)

That’s it today. Have a great week. – Don

Have any interest in day trading the new Micro E-mini stock index futures? If so, please consider my new book on the subject available on Amazon: (read more at this link)

NEW: I have a new YouTube Channel devoted entirely to Day Trading the new Micro E-Minis. These new contracts were just introduced by CME in MAY 2019.

They trade in very low $5 and $2 per point increments and therefore provide a very low risk way to learn to day trade the stock indexes. They offer a fun way to make a few bucks and the commissions are about $1 per trade (per side) and the margins are 1/10th of the E-Mini contracts. Check’em out: Here’s the link to the new channel if you’d like to take a peek: LINK

Free prime shipping on Amazon

Click on the book’s below for more info about them. Thank you.

I do a lot of my own trading with TastyWorks because I like the easy-to-use platform and they have lower commissions than most. The customer service is outstanding. I have an affiliate link and recommend them often for months now and I’ve never had any negative feedback. They also have excellent free mobile apps that are easy to use- and they have ACH free money transfers to-and-from you bank account (usually one day free service.) TastyWorks has just joined Schwab, ThinkOrSwim, and other brokers and introduced NO Commission stock trading.

TastyWorks: $2,000 minimum to open account. Easy online application, free ACH money transfers.

Read more about TastyWorks at this link please: http://daytradingmicros.com/brokers/

TastyWorks also has commissions on the new Micro e-Mini futures at only 85 cents.

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.