Greetings: I closed out my short NOV19 Soybean 1100-strikes Tuesday at 4.25. I had sold them for 3.00 cents, so my loss was (not incl commissions) (4.25 minus 3.0) * $50 = -$56.25 per option.

I closed out my short NOV19 Soybean 1200-strikes Tuesday at 1.625 cents. I had sold them for 2.125 cents, so the small profit was (not incl commissions) (2.125 minus 1.625) * $50 = +$25

Exiting these two positions, as I wrote on Tuesday was to avoid losses as much as possible, so mission accomplished on that. I also expressed my intention to sell more CALL strikes AFTER things settle down and to go as far and high above the money as possible. Ditto, the same for my strategy to sell Corn CALLs.

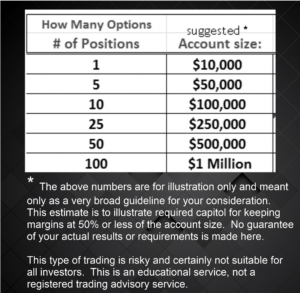

Total P/L on closing trades today*: (not including commissions) Net on closed trades today:

$56.25 minus $25 = -$31.25

Quantity 1 each: -$31.25

Quantity 5 each: –$156.25

Quantity 10 each: –$312.25

*This is for illustration only. Past results are never an indicator of future results. Trading commodity options is risky and not suitable for all investors.

This morning’s post on Ag TV pretty much sums up the flooding, late planting on both beans and corn – and they usually include a daily update on the weather forecasts. You may want to save this link in your browser’s bookmarks: https://www.agweb.com/agday/ Remember this TV show’s primary audience is the farmers.

At midday today on Thursday, beans are up +8 cents and corn up +10 cents – and nobody body knows where the top will be for those prices. Keep in mind I am watching the DEC19 Corn and the NOV19 beans contacts, and everyday I look at the CALL options. The IV% implied volatility on all the far OTM strikes is way up and could go higher. Of course, I won’t be able to find the exact top of this market, but I am at this time – certainly enjoying standing aside to see where it goes and how high of strikes I will be able to sell. Keep in mind that market moves are not always straight lines and there will be some back and fill. The nice thing about selling commodity options is that with the IV% going higher and higher, I”ll be able to sell farther (safer) OTM strikes.

This will be easier to do with soybeans than corn due to the very, very high stocks of beans. Conversely, there will probably be a tightening supply of corn and how much that will be– is yet to be determined as we study reports on: planting progress, the number of acres able to be planted, the weather conditions (drier next week, then more rain?), and more. I do not feel we’ll have the answers to these questions before the weekend. These markets can move up or down 10 cents really fast and without notice with all the uncertainty. My job is to keep an eye on the bigger picture and not allow emotions to read too much into the day to day price movements. It can be enormously fun to try and guess what is next but it is better to keep out of risky temptations and to remain on the tasks of finding some profit by selling very far OTM (FOTM) strikes. Patience is key, and all the while knowing we won’t be able to pick the exact top; it is a time for balance, not hurriedness. This planting-flooding is not a thing that resolves in a quick two or three days.

Other Markets: The $US Dollar has significant gains this week and the shorter term US Treas. are paying more than the long term right now (an inverted yield curve.) I am hanging on to my current positions at present. There is a nice profit in the short SEP19 80-strike Crude oil CALLs. I might consider pocketing some profit there soon. Also, my short DEC19 Corn 330-strike PUTs have some money there – and I know that eventually after Corn peaks this summer – prices will sink into the harvest in SEP and beyond. These 330-strikes are so far OTM (FOTM) that IV% is more a factor in their price now than is the underlying DEC19 futures price. With trades like these – a trader has to ask himself/herself, “What is the risk vs. reward of risking current profits?” There is rarely an easy answer to this one. With the coming of the new month this weekend, I am inclined to wait and see what happens early next week before taking some profits and putting on new positions. I will be studying the history charts of implied volatility this weekend and will comment on how it stands for Crude, Corn, Gold, and Beans in Monday’s Trade Commentary. This will also give me a day or two that will allow the “news cycle” to evolve a bit and maybe better define some direction, but I’m not too optimistic about finding it.

My plan for JUNE is to follow up on all these things, write more strangles with the opportunities- and to stay in the know on fundamentals so I’ll better be able to recognize when thing might be ‘overdone’ in these markets. While the higher yields keep me trading these selling commodity option strategies and willing to take a higher level or risk to find it, I also enjoy the fact that this type of trading keeps the main challenge is just trying to portend “where prices WILL NOT go,” rather than the much tougher target of trying to trade with long positions that require more exact timing and price amplitude. In the new month, I will be studying option classes father out in time, searching for high IV% priced strikes to sell that are very FOTM – pretty much the same thing I’ve been doing. While I normally like to have more than just 3 positions open, I will not let that rush me into any decisions. Will I be able to catch every opportunity and maximize every trade? Almost certainly not. This type of trading is more geared to staying out of the ditches than to speeding down the road.

I can’t imagine the tremendous pressures that must be on corn and soybean growers in the USA at this time. Trying to study prevent-plant dates, buy shorter time-yield seeds in expectation of lower yields, waiting on the weather for so many of these important decisions, and having to decide when to sell futures to hedge higher prices. A wrong decision can have consequences on their profitability for many years. And all I have to do is decide when to sell the CALLs as far OTM as possible. When these farmers sell high futures prices to hedge crops, they immediately become at risk for non-delivery if their crops are damaged (very risky). For this reason, they cannot hedge 100% of a crop, even if (which they can’t) know what the yield will be. I have great appreciation for all these hard-working and brave people do. My job is easy. I worked for 25 years as a private commodity hedge consultant for producers and buyers of commodities to help them use options to hedge both price and delivery risks. You could say I “worked on the other side of the fence” for all those years. It’s really messy over there right now. Have a great weekend. In Monday’s commentary post June 2nd, I’ll be taking a look at some of the option price matrix tables and present some examples of option shopping. – Don

Don A. Singletary

Summary of my Positions 30 May 2019:

Short SEP19 Crude Oil 80-strike CALL for 0.17

Short SEP19 Gold 1500 CALL for 0.70

Short the DEC19 Corn 330 for 2.0 cents ($100.)

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Greetings: I closed out my short NOV19 Soybean 1100-strikes Tuesday at 4.25. I had sold them for 3.00 cents, so my loss was (not incl commissions) (4.25 minus 3.0) * $50 = -$56.25 per option.

I closed out my short NOV19 Soybean 1200-strikes Tuesday at 1.625 cents. I had sold them for 2.125 cents, so the small profit was (not incl commissions) (2.125 minus 1.625) * $50 = +$25

Exiting these two positions, as I wrote on Tuesday was to avoid losses as much as possible, so mission accomplished on that. I also expressed my intention to sell more CALL strikes AFTER things settle down and to go as far and high above the money as possible. Ditto, the same for my strategy to sell Corn CALLs.

Total P/L on closing trades today*: (not including commissions) Net on closed trades today:

$56.25 minus $25 = -$31.25

Quantity 1 each: -$31.25

Quantity 5 each: –$156.25

Quantity 10 each: –$312.25

*This is for illustration only. Past results are never an indicator of future results. Trading commodity options is risky and not suitable for all investors.

This morning’s post on Ag TV pretty much sums up the flooding, late planting on both beans and corn – and they usually include a daily update on the weather forecasts. You may want to save this link in your browser’s bookmarks: https://www.agweb.com/agday/ Remember this TV show’s primary audience is the farmers.

At midday today on Thursday, beans are up +8 cents and corn up +10 cents – and nobody body knows where the top will be for those prices. Keep in mind I am watching the DEC19 Corn and the NOV19 beans contacts, and everyday I look at the CALL options. The IV% implied volatility on all the far OTM strikes is way up and could go higher. Of course, I won’t be able to find the exact top of this market, but I am at this time – certainly enjoying standing aside to see where it goes and how high of strikes I will be able to sell. Keep in mind that market moves are not always straight lines and there will be some back and fill. The nice thing about selling commodity options is that with the IV% going higher and higher, I”ll be able to sell farther (safer) OTM strikes.

This will be easier to do with soybeans than corn due to the very, very high stocks of beans. Conversely, there will probably be a tightening supply of corn and how much that will be– is yet to be determined as we study reports on: planting progress, the number of acres able to be planted, the weather conditions (drier next week, then more rain?), and more. I do not feel we’ll have the answers to these questions before the weekend. These markets can move up or down 10 cents really fast and without notice with all the uncertainty. My job is to keep an eye on the bigger picture and not allow emotions to read too much into the day to day price movements. It can be enormously fun to try and guess what is next but it is better to keep out of risky temptations and to remain on the tasks of finding some profit by selling very far OTM (FOTM) strikes. Patience is key, and all the while knowing we won’t be able to pick the exact top; it is a time for balance, not hurriedness. This planting-flooding is not a thing that resolves in a quick two or three days.

Other Markets: The $US Dollar has significant gains this week and the shorter term US Treas. are paying more than the long term right now (an inverted yield curve.) I am hanging on to my current positions at present. There is a nice profit in the short SEP19 80-strike Crude oil CALLs. I might consider pocketing some profit there soon. Also, my short DEC19 Corn 330-strike PUTs have some money there – and I know that eventually after Corn peaks this summer – prices will sink into the harvest in SEP and beyond. These 330-strikes are so far OTM (FOTM) that IV% is more a factor in their price now than is the underlying DEC19 futures price. With trades like these – a trader has to ask himself/herself, “What is the risk vs. reward of risking current profits?” There is rarely an easy answer to this one. With the coming of the new month this weekend, I am inclined to wait and see what happens early next week before taking some profits and putting on new positions. I will be studying the history charts of implied volatility this weekend and will comment on how it stands for Crude, Corn, Gold, and Beans in Monday’s Trade Commentary. This will also give me a day or two that will allow the “news cycle” to evolve a bit and maybe better define some direction, but I’m not too optimistic about finding it.

My plan for JUNE is to follow up on all these things, write more strangles with the opportunities- and to stay in the know on fundamentals so I’ll better be able to recognize when thing might be ‘overdone’ in these markets. While the higher yields keep me trading these selling commodity option strategies and willing to take a higher level or risk to find it, I also enjoy the fact that this type of trading keeps the main challenge is just trying to portend “where prices WILL NOT go,” rather than the much tougher target of trying to trade with long positions that require more exact timing and price amplitude. In the new month, I will be studying option classes father out in time, searching for high IV% priced strikes to sell that are very FOTM – pretty much the same thing I’ve been doing. While I normally like to have more than just 3 positions open, I will not let that rush me into any decisions. Will I be able to catch every opportunity and maximize every trade? Almost certainly not. This type of trading is more geared to staying out of the ditches than to speeding down the road.

I can’t imagine the tremendous pressures that must be on corn and soybean growers in the USA at this time. Trying to study prevent-plant dates, buy shorter time-yield seeds in expectation of lower yields, waiting on the weather for so many of these important decisions, and having to decide when to sell futures to hedge higher prices. A wrong decision can have consequences on their profitability for many years. And all I have to do is decide when to sell the CALLs as far OTM as possible. When these farmers sell high futures prices to hedge crops, they immediately become at risk for non-delivery if their crops are damaged (very risky). For this reason, they cannot hedge 100% of a crop, even if (which they can’t) know what the yield will be. I have great appreciation for all these hard-working and brave people do. My job is easy. I worked for 25 years as a private commodity hedge consultant for producers and buyers of commodities to help them use options to hedge both price and delivery risks. You could say I “worked on the other side of the fence” for all those years. It’s really messy over there right now. Have a great weekend. In Monday’s commentary post June 2nd, I’ll be taking a look at some of the option price matrix tables and present some examples of option shopping. – Don

Don A. Singletary

Summary of my Positions 30 May 2019:

Short SEP19 Crude Oil 80-strike CALL for 0.17

Short SEP19 Gold 1500 CALL for 0.70

Short the DEC19 Corn 330 for 2.0 cents ($100.)

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.