Crude Oil: There doesn’t seem to be any major changes in the oil fundamentals. The story (below) from cmdty newswires is a quick snapshot of things. The market is in the shadow of fear about the world economy and trade negotiations. There is a record high amount of U.S. gasoline stocks and USA production at over 12 million bpd now.

Big Picture Crude Oil Market Factors: Bullish factors include (1) the -560,000 bpd decline in OPEC Feb crude production to a 4-year low of 30.5 million bpd, (2) comments from Saudi Energy Minister Khalid Al-Falih that Saudi Arabia will cut its crude production to 9.8 million bpd in March, the lowest in 11 months and well below the 10.3 million bpd output target agreed in the OPEC+ deal, (3) the action by the Trump administration to slap sanctions on Venezuela’s national oil company PDVSA, which will block the company from exporting crude oil to the U.S. and restrict supplies, (4) the reinstatement of full U.S. sanctions on Iran as of Nov 5, although the U.S. gave waivers to 8 countries for up to 1.25 mln bpd of Iranian exports, and (5) the agreement by OPEC+ on Dec 7 to cut crude oil production by 1.2 million bpd for the first six months of 2019 (800,000 bpd for OPEC members), which should soak up much of the expected 2019 global oil surplus. Bearish factors include (1) the surge in U.S. oil production to a record high of 12.1 million bpd, (2) the recent surge in U.S. gasoline inventories to a record high 259.6 million bbl, and (3) the recent increase in crude supplies at Cushing, the delivery point for WTI futures, to a 14-month high.

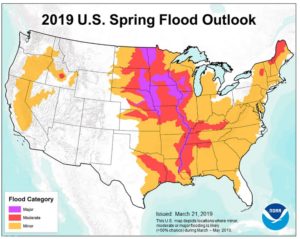

The fear is that more rain will compound flooding as the runoff flows South into more areas.

Corn commentary continued: Corn prices turned up the second half of the week. The tariff talks between USA and China aren’t expected to bring much news until April now, though each day more rumors are appearing. One report says the grain buys (corn and soybeans mostly) negotiations are completed but all the announcements will come at one time when this round of negotiations are completed in April.

The COT (commitment of traders) reports show “funds holding a record net short position of 257,965 contracts.” Any sizable corn purchases by China from the USA (hundreds of millions of bushels) would likely spark fast buying of futures in the corn markets. This news and the flooding, which stalls and delays new crop plantings of corn could raise prices this time of year.

You can sign up to receive the March 29, 2019 PROSPECTIVE PLANTINGS report from the USDA, or just go to this link on the date (12:00 Noon New York) to see it at: https://usda.library.cornell.edu/concern/publications/x633f100h?locale=en Acres (intentional plantings estimates) are just one part of the production equation. The USA produces about just under 15 billion bushels of corn per year, uses are about: one-third for animal feed, one-third for ethanol production, and the remainder for food products and seed.

Here’s a page from Friday’s KSU Grains Newsletter 3/21/2019: You can download the entire PDF at: https://www.timefarming.com/KSRN.pdf There is also a radio version available on their website.

(S/U = Stocks-to-Use Ratio) At present the prospective planting acres number for corn is about 89.1 million acres; there is no reason to suspect that will vary much in the report on 29 March 2019.

I might revisit the idea of selling another strike of the DEC19 Corn PUT. I am currently short the 330 PUT @ 2.0 cents DEC19.

Gold: At present, I am only short one strike in Gold, the AUG19 1500 CALL. With the Dow Avg down -460 on Friday and news abounding of a weaker global economy, it might not be prudent to sell any more CALLs at this time. However, I’ll be watching the progress of Gold prices and it it seems more upside is in the near term, I will shop for PUTS— and then later (should gold go up) will shop for CALLs to form more short strangles. My hope is to have at least two and maybe three different short gold strangles in place soon. I may be more aggressive in shopping for an AUG19 Gold PUT to go with the short 1500-strike CALL this week, and then wait to place other strangles soon, just not in the next week or two.

Soybeans: I have stalled selling CALLs on soybeans due to the fear that a trade deal might announce large purchases by China for USA soybeans. It hasn’t happened and prices have dwindled back down to $US 9.38 a bushel basis the NOV19 futures contract. All this time China has found plenty of beans to buy at good prices from Brazil and other countries. I’m going to take a hard look for some CALLs to shop (sell) this week.

Summary of My Positions:

Short SEP19 Crude Oil strangle, the 80-strike CALL and the 35-strike PUT for 0.26 ($260) (0.09 for the 35P and .17 for the 80C) = total 0.26 ($260)

This new Trade Origination button will take you back in time – to the post where the trade was originally placed, so you can review the chart, fundamentals, and the details of this trade’s selection. This way you get much more than just the position listing. – DAS

Short the JUL19 Crude Oil strangle, the 75-strike CALL and the 45-strike PUT for 0.29 ($290) (0.11 for the 75C and 0.18 for the 45P) = total $290 (not incl. comm.)

Short Gold AUG19 1500-strike CALL for 2.00 ($200)

Short the DEC19 Corn 330 for 2.0 cents ($100.)

Coming Soon: Extra Video Training

I will be adding one to two new videos each week into a TAB named Video Training Library on this website. Some of these videos will also be posted on YouTube. I just posted a new video yesterday on my YouTube Channel about the type of investing featured here on the website. I will link it here (below). If you want a friend fellow-investor to see what we do here, this is a short 12 minute video that explains our strategy – and it has links to the free trial offer also. If you are new to the Option Training Income Bulletin (formerly the Time Farming Training Bulletin), please view it when you can. Thank you. If you wish to send the link to someone, just email this URL: https://youtu.be/i_zLeBoXN6M

Here’s the video. Have a great week. Thank you – Don

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Don A. Singletary is a teacher and writer. For 25 years he was a commodity risk management (hedge) consultant for major corporations. He is the author of Option Income Training Bulletin, the only such publication dedicated to teaching small/medium personal investors how to sell commodity options for a second income, a strategy traditionally used mostly by professional investors, the wealthy, and money managers.

While this website is for subscribers only, you can get full access with a free trial subscription. Also you may visit his blog with many trade examples and articles on this valuable strategy at: SellingCommodityOptions.com

Crude Oil: There doesn’t seem to be any major changes in the oil fundamentals. The story (below) from cmdty newswires is a quick snapshot of things. The market is in the shadow of fear about the world economy and trade negotiations. There is a record high amount of U.S. gasoline stocks and USA production at over 12 million bpd now.

Corn: In just a few days, the USDA will issue a report on planting intention surveys to give us a starting number on just how many acres of Corn might be planted for 2019-2020 season. The floods in the USA midwest corn belt will likely delay plantings this spring. Long range weather forecasts are for more rain. There’s some very good pictures and maps in this article: https://www.washingtonpost.com/weather/2019/03/19/satellite-images-show-devastating-floods-midwest/?noredirect=on&utm_term=.a31de15caa03

The fear is that more rain will compound flooding as the runoff flows South into more areas.

Corn commentary continued: Corn prices turned up the second half of the week. The tariff talks between USA and China aren’t expected to bring much news until April now, though each day more rumors are appearing. One report says the grain buys (corn and soybeans mostly) negotiations are completed but all the announcements will come at one time when this round of negotiations are completed in April.

The COT (commitment of traders) reports show “funds holding a record net short position of 257,965 contracts.” Any sizable corn purchases by China from the USA (hundreds of millions of bushels) would likely spark fast buying of futures in the corn markets. This news and the flooding, which stalls and delays new crop plantings of corn could raise prices this time of year.

You can sign up to receive the March 29, 2019 PROSPECTIVE PLANTINGS report from the USDA, or just go to this link on the date (12:00 Noon New York) to see it at: https://usda.library.cornell.edu/concern/publications/x633f100h?locale=en Acres (intentional plantings estimates) are just one part of the production equation. The USA produces about just under 15 billion bushels of corn per year, uses are about: one-third for animal feed, one-third for ethanol production, and the remainder for food products and seed.

If you are not yet familiar with the Kansas State University Ag Economic Dept visit the link from this website’s Resource Page and scroll down to the KSU listings at: https://www.timefarming.com/blog/resource-links-library/

Here’s a page from Friday’s KSU Grains Newsletter 3/21/2019: You can download the entire PDF at:

https://www.timefarming.com/KSRN.pdf There is also a radio version available on their website.

(S/U = Stocks-to-Use Ratio) At present the prospective planting acres number for corn is about 89.1 million acres; there is no reason to suspect that will vary much in the report on 29 March 2019.

I might revisit the idea of selling another strike of the DEC19 Corn PUT. I am currently short the 330 PUT @ 2.0 cents DEC19.

Gold: At present, I am only short one strike in Gold, the AUG19 1500 CALL. With the Dow Avg down -460 on Friday and news abounding of a weaker global economy, it might not be prudent to sell any more CALLs at this time. However, I’ll be watching the progress of Gold prices and it it seems more upside is in the near term, I will shop for PUTS— and then later (should gold go up) will shop for CALLs to form more short strangles. My hope is to have at least two and maybe three different short gold strangles in place soon. I may be more aggressive in shopping for an AUG19 Gold PUT to go with the short 1500-strike CALL this week, and then wait to place other strangles soon, just not in the next week or two.

Soybeans: I have stalled selling CALLs on soybeans due to the fear that a trade deal might announce large purchases by China for USA soybeans. It hasn’t happened and prices have dwindled back down to $US 9.38 a bushel basis the NOV19 futures contract. All this time China has found plenty of beans to buy at good prices from Brazil and other countries. I’m going to take a hard look for some CALLs to shop (sell) this week.

Summary of My Positions:

Short SEP19 Crude Oil strangle, the 80-strike CALL and the 35-strike PUT for 0.26 ($260)

(0.09 for the 35P and .17 for the 80C) = total 0.26 ($260)

This new Trade Origination button will take you back in time – to the post where the trade was originally placed, so you can review the chart, fundamentals, and the details of this trade’s selection. This way you get much more than just the position listing. – DAS

Short the JUL19 Crude Oil strangle, the 75-strike CALL and the 45-strike PUT for 0.29 ($290)

(0.11 for the 75C and 0.18 for the 45P) = total $290 (not incl. comm.)

Short Gold AUG19 1500-strike CALL for 2.00 ($200)

Short the DEC19 Corn 330 for 2.0 cents ($100.)

Coming Soon: Extra Video Training

I will be adding one to two new videos each week into a TAB named Video Training Library on this website. Some of these videos will also be posted on YouTube. I just posted a new video yesterday on my YouTube Channel about the type of investing featured here on the website. I will link it here (below). If you want a friend fellow-investor to see what we do here, this is a short 12 minute video that explains our strategy – and it has links to the free trial offer also. If you are new to the Option Training Income Bulletin (formerly the Time Farming Training Bulletin), please view it when you can. Thank you. If you wish to send the link to someone, just email this URL: https://youtu.be/i_zLeBoXN6M

Here’s the video. Have a great week. Thank you – Don

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.