Corn: A report released on Friday: Agricultural Outlook Forum 2019 Released: Friday, February 22, 2019 GRAINS AND OILSEEDS OUTLOOK FOR 2019 Prepared by Members of the Wheat, Feed Grains, Rice, and Oilseeds Interagency Commodity Estimates Committees U.S. Department of Agriculture:

Comment: This report is quite extensive. Digesting the whole thing is probably not necessary at all. I excerpted some of it to post here. Most of the essence of the report is expressed in the front pages, here is the Corn summary (for example):

Corn Supply, Demand, and Price Outlook for 2019/20 (Table 3) The U.S. corn outlook for 2019/20 is for increased production, domestic use, and exports, and lower stocks. The corn crop is projected at 14.9 billion bushels, 3 percent above a year ago as an increase in area more than offsets a lower yield. The yield projection of 176.0 bushels per acre is based on a weather-adjusted trend assuming normal planting progress and summer growing season weather. 2 Despite beginning stocks that are forecast down from a year ago, total corn supplies are up slightly on a larger crop. Total U.S. corn use in 2019/20 is forecast to rise 1 percent from a year ago on increases to domestic use and exports. Food, seed, and industrial (FSI) use is projected unchanged at 7.0 billion bushels. Corn used for ethanol is unchanged from a year ago, based on expectations of flat motor gasoline consumption and a slight decline in ethanol’s inclusion rate into gasoline that is essentially offset by continued growth in exports. Feed and residual use is up 125 million bushels to 5.5 billion, with a larger crop and continued growth in grain consuming animal units. Corn exports are up 25 million bushels to 2.5 billion, reflecting expectations of modest growth in global trade and a slight decline in U.S. market share with competition from other exporters. Ending stocks are projected at 1.7 billion bushels, down 5 percent from 2018/19, supporting a 5 cent per bushel increase from a year ago in the expected season-average farm price to $3.65 per bushel.

The link to the entire report at the Kansas State University website is here: https://www.agmanager.info/grain-marketing/grain-market-outlook-newsletter

Comment continued: When reading USDA reports, one must remember they are not in the business of speculation and commentary; their role is to use consistent methods that make numerical projections based on the history of stocks and price data. What I’m attempting to point out is the fact that any expectations about the results and impact of tariff negotiations is NOT expressed or entered into the USDA numbers in this (and other reports.) USDA reports ARE often used as a baseline on which other people and organizations might base such speculation. Typically, the data might be used to extrapolate and project various scenarios for crop yields in order to illustrate things that could come to pass – so a reader might think through some possibilities. For example: “What would happen to price and stocks if the corn yield was up or down from the USDA projections?”

Here are a few numbers that I think are important to ponder when it comes to grains, especially soy beans and corn this year: In the news on Friday of last week was this: “China trade deal might include an additional $30 billion in US agricultural product purchases.” This, as you know is not a fact yet; this is the sort of “news” that will NOT be published in an official report. If it becomes fact, it will be entered into the USDA data as it happens, not before. This is why the day-to-day news on trade negotiations will impact trading prices. Analyst and commentators will use the USDA baseline and run scenarios based on postulations on news reports.

It is important to know and follow the trade negotiations for many reasons. China’s agricultural purchases in 2018 were $16 billion. The prior year in 2017, they were $24 billion. So you see a 33% decline in 2018 compared to the previous year. This allows us to imagine the how impact of an increase of $30 billion in 2019 – would be a tremendous increase. In parallel news last week, there were discussions about possible increases in exports of oil and ethanol to China. I mentioned the extremely high tariff rates in China on USA ethanol. Any increases in ethanol buying by China would have a large bullish influence on corn prices.

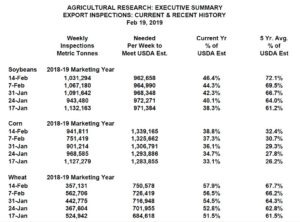

Also during the middle of last week, another USDA publication came out called the (monthly) Export Inspections. If you understand that “Export Inspections” is where the “amount exported” figures are from, then this name (the “Export Inspections”) makes sense. There is some good information on this summary page.

Short Video with comments about this Export Inspection Report:

Click on this link to play or download: https://www.timefarming.com/25.mp4

Comments continued (25feb2019):

Nothing new to comment on Crude Oil or Gold right now. The focus seems to be on the global economic outlook and more meetings scheduled between US officials and Asian counterparts.

Looking out to Spring and Summer regarding the price outlook for the grains. Some analyst are advising farmers that they should place some seasonal hedges in higher prices in Soybeans and Corn. The thinking there is that good news on export increases in the grains might give a bounce up in prices, while the fundamentals (especially with beans) are just not very bullish at all. Some of these suggestion indicate that price peaks for grain may come sooner this year than later. I am closely watching the DEC19 Corn, as I want to place short CALLs far up and out-of-the-money on the DEC19 futures this year.

I also am watching the far OTM CALLs on soybeans, but I’m still waiting for more definite news that could spike prices a bit yet.

OIL: Keep in mind 2019: This year is when crude oil production in the USA should exceed 12 million bpd (barrels per day.) If you have an interest in some context as to what this means as the USA gets less “oil dependent,” – if you haven’t see that film on Amazon titled The Crude Poker Game, is a good documentary (54 min. long.)

Watch later this week for more commentary.

That is all today. Have a great week. – Don

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Corn: A report released on Friday: Agricultural Outlook Forum 2019 Released: Friday, February 22, 2019 GRAINS AND OILSEEDS OUTLOOK FOR 2019 Prepared by Members of the Wheat, Feed Grains, Rice, and Oilseeds Interagency Commodity Estimates Committees U.S. Department of Agriculture:

The link to the entire report at the Kansas State University website is here: https://www.agmanager.info/grain-marketing/grain-market-outlook-newsletter

Comment continued: When reading USDA reports, one must remember they are not in the business of speculation and commentary; their role is to use consistent methods that make numerical projections based on the history of stocks and price data. What I’m attempting to point out is the fact that any expectations about the results and impact of tariff negotiations is NOT expressed or entered into the USDA numbers in this (and other reports.) USDA reports ARE often used as a baseline on which other people and organizations might base such speculation. Typically, the data might be used to extrapolate and project various scenarios for crop yields in order to illustrate things that could come to pass – so a reader might think through some possibilities. For example: “What would happen to price and stocks if the corn yield was up or down from the USDA projections?”

Here are a few numbers that I think are important to ponder when it comes to grains, especially soy beans and corn this year: In the news on Friday of last week was this: “China trade deal might include an additional $30 billion in US agricultural product purchases.” This, as you know is not a fact yet; this is the sort of “news” that will NOT be published in an official report. If it becomes fact, it will be entered into the USDA data as it happens, not before. This is why the day-to-day news on trade negotiations will impact trading prices. Analyst and commentators will use the USDA baseline and run scenarios based on postulations on news reports.

It is important to know and follow the trade negotiations for many reasons. China’s agricultural purchases in 2018 were $16 billion. The prior year in 2017, they were $24 billion. So you see a 33% decline in 2018 compared to the previous year. This allows us to imagine the how impact of an increase of $30 billion in 2019 – would be a tremendous increase. In parallel news last week, there were discussions about possible increases in exports of oil and ethanol to China. I mentioned the extremely high tariff rates in China on USA ethanol. Any increases in ethanol buying by China would have a large bullish influence on corn prices.

Also during the middle of last week, another USDA publication came out called the (monthly) Export Inspections. If you understand that “Export Inspections” is where the “amount exported” figures are from, then this name (the “Export Inspections”) makes sense. There is some good information on this summary page.

Short Video with comments about this Export Inspection Report:

Click on this link to play or download: https://www.timefarming.com/25.mp4

Comments continued (25feb2019):

Nothing new to comment on Crude Oil or Gold right now. The focus seems to be on the global economic outlook and more meetings scheduled between US officials and Asian counterparts.

Looking out to Spring and Summer regarding the price outlook for the grains. Some analyst are advising farmers that they should place some seasonal hedges in higher prices in Soybeans and Corn. The thinking there is that good news on export increases in the grains might give a bounce up in prices, while the fundamentals (especially with beans) are just not very bullish at all. Some of these suggestion indicate that price peaks for grain may come sooner this year than later. I am closely watching the DEC19 Corn, as I want to place short CALLs far up and out-of-the-money on the DEC19 futures this year.

I also am watching the far OTM CALLs on soybeans, but I’m still waiting for more definite news that could spike prices a bit yet.

OIL: Keep in mind 2019: This year is when crude oil production in the USA should exceed 12 million bpd (barrels per day.) If you have an interest in some context as to what this means as the USA gets less “oil dependent,” – if you haven’t see that film on Amazon titled The Crude Poker Game, is a good documentary (54 min. long.)

Watch later this week for more commentary.

That is all today. Have a great week. – Don

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.