March 11, 2019: TRADE COMMENTARY

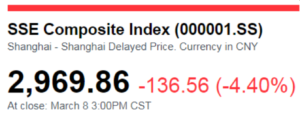

GOLD: China reported a decrease of exports much larger than expected – down 20% year-over-year. The Shanghai Index (symbol: SSE) dropped 4.4%, the DOW equivalent of a drop of over 1,000 points in a day. Jitters of a faltering or at least weaker worldwide economy increased the “safe-haven” purchases of gold – and the weaker $US Dollar resulted in gold futures prices moving up just over $12.50 per ounce.

CORN: I exited my short Corn JUL19 360 PUTs on Friday. A somewhat bearish WASDE USDA report (World Supply-Demand) and the fact that prices were getting too close to the strike for comfort was the primary reason I cut losses while they are still fairly small. (See my comments about that from Friday’s newsletter at: https://www.timefarming.com/blog/08-march-2019/

Several analyst think that all the “negative news” is now built-in to corn prices and they site the possibility that China’s present difficulty economically could drive them to try and settle the tariff disputes sooner rather than later. It is true, I think, that a trade deal that would allow huge corn purchases from the USA for feed – and another part of the agreement might allow large purchases of ethanol would certainly boost corn prices. I (nor anyone else) is sure of the timing of such an agreement. There is the potential for a huge move up in Corn, but the question remains “when?”

CRUDE OIL: Crude had a volatile trading week and even though it was down $1.50 and more Friday morning, it managed to close off by .70 to .80 a barrel by end of day. I am comfortable with my current positions in both Crude and Gold for now. I am also already looking into SEP, OCT, NOV 2019 options to add to my positions.

SOYBEANS: Friday’s USDA report again reinforced what can be called burdensome supplies all year for soybeans. I’ll be posting updated Supply – Demand charts for soybeans and corn later this week. I’ll be examining the idea of selling NOV19 soybean CALLs and also take a look at premiums for SEP and DEC corn CALL options. I do want to wait and see the news and other reports this week on both trade talks and China’s economic outlook and forecasts; these will be key in setting the pace for prices, especially in soybeans and corn. There seems to be such huge stocks of soybeans that no perceived amount of buying could bump their prices up in any huge move. On the other hand, that is not the case with corn.

Summary of My Positions 11MAR2019:

Short JUN19 Crude Oil 45PUT @ 0.24 ($240)

Short SEP19 Crude Oil short strangle, the 80-strike CALL and the 35-strike PUT for a total of 0.26 ($260)

(0.09 for the 35P and .17 for the 80C) = total 0.26 ($260)

Short the Gold JUN19 1200-strike PUT for 1.40 ($140)

Short the Gold AUG19 1500 CALL at 2.00 ($200)

A Chart Review of positions:

Tips on Trade Management:

Whether your account is $10k or $1 Million, a trader selling options like my current positions should strive to keep the margin requirements of all trades around 50% or less – of the account size. Some traders are ok with 25% to 50% range but I would suggest that 50% would be a good goal. Even if a trader thinks his/her risk tolerance is high, any account even close to a margin call can cause a skew in trade management decisions for most people. There is sometimes a very fine line between trade management in a trading plan and substituting hope as a trading strategy; the latter can be disastrous.

One thing I strongly suggest to traders, especially those without considerable experience, is not to think of a losing trade as a failure. Unlike many things in life that are success or failures, there are many things about these strategies that we have no control over. (Like the China trade talks for example.) In my mind, a trader only fails if he/she lets an errant trade accumulate excessive drawn-downs (losses) and then gets exasperated enough to substitute “hope” for his/her trading plan.

There is a trade off to writing naked commodity options. On the one hand, we get to pick trades that usually have a very high Probability of Profit (aka: Prob. OTM = probability of expiring out-of-the-money.) On the other hand, the profit I seek is not a huge windfall but a reasonable modest profit – so we must keep losses to a minimum. Most of the trades at the time they are placed– usually have a delta of .1 to 0.05 and a Prob OTM of 90% to 95%.

If you didn’t make this connection yet, here’s how you can compute a trade’s “Prob OTM” from the delta of the trade:

A delta of 0.10 = (1-.1) x 100 = 90%

A delta of 0.05= (1-0.05) x 100 = 95%

Having a very low delta on a trade means that the price of the option will vary slowly as changes in the underlying’s price varies. The closer the price of the underlying to the strike, the HIGHER the delta – and and there is an increasing rate of accumulating losses (a higher gamma) a the underlying price approaches the strike price of the option.

Gamma, , measures the rate of change in the delta with respect to changes in the underlying price.Gamma is the second derivative of the value function with respect to the underlying price. Most long options have positive gamma and most short options have negative gamma.

Don’t feel like you are lapsing in some way if you are not familiar with some of these option terms (commonly called “the Greeks”.) There is a tendency by some traders to think all option traders should emphasize these terms. I would say it is far more important to understand that as the underlying futures contract gets closer to the strike of a trade, your risk increases; that is all that is necessary. You really don’t need to “speak Greek” to understand that. Let me say this a different way: You don’t need to learn to “speak Greek”, but you do need to understand the dynamics of your trades. If you stop and think about it, it seems almost common sense that the closer a contract gets to your trade’s strike price, the more risky it becomes. I like to keep it simple as much as possible. The best traders I have ever known are the ones who see things truthfully (realistically) and simply.

Another of the “rule of thumb” guidelines I shoot for is to keep the potential returns of a trade at the time it is placed – to 20% or more. All rules have some exceptions. There are times when you have plenty of margin available in your account and you may see a simple, almost “slam dunk” (sure thing) of a trade that pays less than 20% but still looks very attractive.

One of the toughest disciplines of all in every kind of trading is “to do nothing.” There are plenty of times over the years when I have spent hours and hours combing through possible trades. I’d put in so much effort that it would seem “wrong” NOT TO DO SOMETHING. There is an old expression that says, “You get all dressed up and there is no place to go.” Some of the most successful trades you make are the one’s you NEVER do. I get a lot of email from readers and I enjoy all of them. One of the most common things that causes me to get more email, is when my trade activity is low. I appreciate enthusiasm in all it’s forms, but to trade just because my activity is low – is not a legitimate criteria. When you trade with real money, there is no “target practice,” it all counts equally. There is nothing wrong (and I even encourage it) with keeping some “target practice” trades in a notebook or in the ‘paper money’ account your broker provides for you. This is a great way to gain experience without risking your capital. It is true it’s not quite the same. Still, it’s a great way to practice and explore trades and strategies

My plan for 2019 is keep adding training videos constantly and I’ll be posting most of them on a special subscriber-only section of the web site. I am eager to hear from readers if you have thoughts and suggestions for topics for them. Just email me at: Don@WriteThisDown.com

Look for more commentary this week on the WASDE grain reports, and to follow up with any news on tariff talks and I should have a new training video in the latter part of the week.

There is a new list of futures option expiration dates for download in the Resource Links Library, here the download link

If you want a copy of the latest (monthly) USDA WASDE report here’s the download link. And here is link to CME (the Merc Exchange with a revised 3/08/2019 Corn ending stocks vs. STU. (the stocks in Friday’s report were revised UP (neutral to bearish)

Thank you and good trading to all – Don

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

March 11, 2019: TRADE COMMENTARY

GOLD: China reported a decrease of exports much larger than expected – down 20% year-over-year. The Shanghai Index (symbol: SSE) dropped 4.4%, the DOW equivalent of a drop of over 1,000 points in a day. Jitters of a faltering or at least weaker worldwide economy increased the “safe-haven” purchases of gold – and the weaker $US Dollar resulted in gold futures prices moving up just over $12.50 per ounce.

CORN: I exited my short Corn JUL19 360 PUTs on Friday. A somewhat bearish WASDE USDA report (World Supply-Demand) and the fact that prices were getting too close to the strike for comfort was the primary reason I cut losses while they are still fairly small. (See my comments about that from Friday’s newsletter at: https://www.timefarming.com/blog/08-march-2019/

Several analyst think that all the “negative news” is now built-in to corn prices and they site the possibility that China’s present difficulty economically could drive them to try and settle the tariff disputes sooner rather than later. It is true, I think, that a trade deal that would allow huge corn purchases from the USA for feed – and another part of the agreement might allow large purchases of ethanol would certainly boost corn prices. I (nor anyone else) is sure of the timing of such an agreement. There is the potential for a huge move up in Corn, but the question remains “when?”

CRUDE OIL: Crude had a volatile trading week and even though it was down $1.50 and more Friday morning, it managed to close off by .70 to .80 a barrel by end of day. I am comfortable with my current positions in both Crude and Gold for now. I am also already looking into SEP, OCT, NOV 2019 options to add to my positions.

SOYBEANS: Friday’s USDA report again reinforced what can be called burdensome supplies all year for soybeans. I’ll be posting updated Supply – Demand charts for soybeans and corn later this week. I’ll be examining the idea of selling NOV19 soybean CALLs and also take a look at premiums for SEP and DEC corn CALL options. I do want to wait and see the news and other reports this week on both trade talks and China’s economic outlook and forecasts; these will be key in setting the pace for prices, especially in soybeans and corn. There seems to be such huge stocks of soybeans that no perceived amount of buying could bump their prices up in any huge move. On the other hand, that is not the case with corn.

Summary of My Positions 11MAR2019:

Short JUN19 Crude Oil 45PUT @ 0.24 ($240)

Short SEP19 Crude Oil short strangle, the 80-strike CALL and the 35-strike PUT for a total of 0.26 ($260)

(0.09 for the 35P and .17 for the 80C) = total 0.26 ($260)

Short the Gold JUN19 1200-strike PUT for 1.40 ($140)

Short the Gold AUG19 1500 CALL at 2.00 ($200)

A Chart Review of positions:

Tips on Trade Management:

Whether your account is $10k or $1 Million, a trader selling options like my current positions should strive to keep the margin requirements of all trades around 50% or less – of the account size. Some traders are ok with 25% to 50% range but I would suggest that 50% would be a good goal. Even if a trader thinks his/her risk tolerance is high, any account even close to a margin call can cause a skew in trade management decisions for most people. There is sometimes a very fine line between trade management in a trading plan and substituting hope as a trading strategy; the latter can be disastrous.

One thing I strongly suggest to traders, especially those without considerable experience, is not to think of a losing trade as a failure. Unlike many things in life that are success or failures, there are many things about these strategies that we have no control over. (Like the China trade talks for example.) In my mind, a trader only fails if he/she lets an errant trade accumulate excessive drawn-downs (losses) and then gets exasperated enough to substitute “hope” for his/her trading plan.

There is a trade off to writing naked commodity options. On the one hand, we get to pick trades that usually have a very high Probability of Profit (aka: Prob. OTM = probability of expiring out-of-the-money.) On the other hand, the profit I seek is not a huge windfall but a reasonable modest profit – so we must keep losses to a minimum. Most of the trades at the time they are placed– usually have a delta of .1 to 0.05 and a Prob OTM of 90% to 95%.

Having a very low delta on a trade means that the price of the option will vary slowly as changes in the underlying’s price varies. The closer the price of the underlying to the strike, the HIGHER the delta – and and there is an increasing rate of accumulating losses (a higher gamma) a the underlying price approaches the strike price of the option.

Don’t feel like you are lapsing in some way if you are not familiar with some of these option terms (commonly called “the Greeks”.) There is a tendency by some traders to think all option traders should emphasize these terms. I would say it is far more important to understand that as the underlying futures contract gets closer to the strike of a trade, your risk increases; that is all that is necessary. You really don’t need to “speak Greek” to understand that. Let me say this a different way: You don’t need to learn to “speak Greek”, but you do need to understand the dynamics of your trades. If you stop and think about it, it seems almost common sense that the closer a contract gets to your trade’s strike price, the more risky it becomes. I like to keep it simple as much as possible. The best traders I have ever known are the ones who see things truthfully (realistically) and simply.

Another of the “rule of thumb” guidelines I shoot for is to keep the potential returns of a trade at the time it is placed – to 20% or more. All rules have some exceptions. There are times when you have plenty of margin available in your account and you may see a simple, almost “slam dunk” (sure thing) of a trade that pays less than 20% but still looks very attractive.

One of the toughest disciplines of all in every kind of trading is “to do nothing.” There are plenty of times over the years when I have spent hours and hours combing through possible trades. I’d put in so much effort that it would seem “wrong” NOT TO DO SOMETHING. There is an old expression that says, “You get all dressed up and there is no place to go.” Some of the most successful trades you make are the one’s you NEVER do. I get a lot of email from readers and I enjoy all of them. One of the most common things that causes me to get more email, is when my trade activity is low. I appreciate enthusiasm in all it’s forms, but to trade just because my activity is low – is not a legitimate criteria. When you trade with real money, there is no “target practice,” it all counts equally. There is nothing wrong (and I even encourage it) with keeping some “target practice” trades in a notebook or in the ‘paper money’ account your broker provides for you. This is a great way to gain experience without risking your capital. It is true it’s not quite the same. Still, it’s a great way to practice and explore trades and strategies

My plan for 2019 is keep adding training videos constantly and I’ll be posting most of them on a special subscriber-only section of the web site. I am eager to hear from readers if you have thoughts and suggestions for topics for them. Just email me at: Don@WriteThisDown.com

Look for more commentary this week on the WASDE grain reports, and to follow up with any news on tariff talks and I should have a new training video in the latter part of the week.

There is a new list of futures option expiration dates for download in the Resource Links Library, here the download link

If you want a copy of the latest (monthly) USDA WASDE report here’s the download link. And here is link to CME (the Merc Exchange with a revised 3/08/2019 Corn ending stocks vs. STU. (the stocks in Friday’s report were revised UP (neutral to bearish)

Thank you and good trading to all – Don

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.