Greetings:

The Mexican tariffs have been ‘suspended indefinitely.’ An agreement was reached on Saturday. More tough talk between USA and China on tariffs (really not new news.)

Perhaps this will clear the air a bit for more normal trading this week. Today, the Crop Progress report is out at 4PM Eastern time (Monday) at: https://usda.library.cornell.edu/catalog?utf8=✓&search_field=all_fields&q=crop+progress+reports

Tomorrow on Tuesday 11th June, the JUNE WASDE report is out at noon Eastern time at: https://www.usda.gov/oce/commodity/wasde/

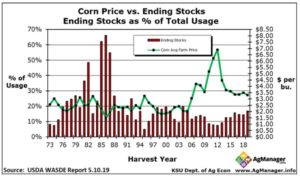

It is expected that the crop progress report late today will continue to reflect the fact that reduced acres and yield drag will be a certainty, although the amount that might be reflected in the WASDE on Tuesday is widely debated. The USDA often will make such adjustments over several months as more factual data becomes available. This means the full effects of reduced acres and lower bushel / acre yields will almost certainly not be in this one report but will happen over time in the next few months. Analysts however, will be posting various scenarios for the new corp crop – and those speculations will drive corn prices over the next few weeks and beyond. Back in 2012 due to drought, a similar reduction of yield occurred and there will be comparisons of price action made. You can see in the chart (below) that prices above $5.50 to $7.00 were in the mix back then. Because, there will be these speculations, there is almost certainly more volatility in corn prices dead ahead.

Here’s the chart with updates for MAY 2019:

For a look at what could happen in the coming weeks, see the post from last week on 04 JUNE here:

https://www.timefarming.com/blog/04-june-2019/

There will be many reports this week after both the crop progress on Monday and the WASDE on Tuesday. I’ll try to sort them out and put something up here about the potential for the corn prices. There will be reductions of both planted acres and the yields coming up and this will be somewhat offset by less demand for USA Corn due to cheap South American product available.

Crude: U. S. Crude oil stocks show a surplus of 46.68 million barrels from a year ago. Announcements for continued cutbacks by Russia and OPEC are expected in the face of slower demand ahead. The USA has not indicated any plans for a crude production cut-back and indeed, more increases are likely. The most widely held opinions are that crude price will continue down a bit. I remain comfortable with my short DEC19 Crude Oil 90C/30P short strangles.

Gold: My short SEP19 1500-stirke CALL options continue with a significant draw down. This option expires in 78 days on August 15, 2019. The Prob. OTM is still around 93%, but I have held this option far past the guideline “200% rule” since it has remained so far OTM. I am likely taking more risk than the premium collected warrants but since I am not heavily weighted (I don’t have a large position in them,) I will wait a bit longer and see what happens.

I’m satisfied with my short DEC19 Gold short strangles 1150 PUT / 1700 CALL positions, and when / if conditions permit, I might extend by selling more short strangles out in the calendar 2020 year in early contracts there.

Comments Continued: With this urgent problem of politics and Mexican tariffs over for now, this could moderate some of the volatility in the stock market and diminish the ‘safe-haven’ buying of Gold we saw last week.

Soybeans: Since, as I’ve mentioned before, the soybeans will move up in sympathy with corn, I’ll wait a while longer and both the crop progress and WASDE reports before selling more soybean NOV19 CALL options. Whatever the outcome of the corn situation, the huge stocks of soybeans and the loss of soybean sales to China due to tariffs and swine flu hog population losses – will very much limit the price of soybeans over the next few months.

Have a great week. I hope the news events allow some new trades this week. All the best – Don

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Greetings:

The Mexican tariffs have been ‘suspended indefinitely.’ An agreement was reached on Saturday. More tough talk between USA and China on tariffs (really not new news.)

Perhaps this will clear the air a bit for more normal trading this week. Today, the Crop Progress report is out at 4PM Eastern time (Monday) at: https://usda.library.cornell.edu/catalog?utf8=✓&search_field=all_fields&q=crop+progress+reports

Tomorrow on Tuesday 11th June, the JUNE WASDE report is out at noon Eastern time at: https://www.usda.gov/oce/commodity/wasde/

It is expected that the crop progress report late today will continue to reflect the fact that reduced acres and yield drag will be a certainty, although the amount that might be reflected in the WASDE on Tuesday is widely debated. The USDA often will make such adjustments over several months as more factual data becomes available. This means the full effects of reduced acres and lower bushel / acre yields will almost certainly not be in this one report but will happen over time in the next few months. Analysts however, will be posting various scenarios for the new corp crop – and those speculations will drive corn prices over the next few weeks and beyond. Back in 2012 due to drought, a similar reduction of yield occurred and there will be comparisons of price action made. You can see in the chart (below) that prices above $5.50 to $7.00 were in the mix back then. Because, there will be these speculations, there is almost certainly more volatility in corn prices dead ahead.

Here’s the chart with updates for MAY 2019:

For a look at what could happen in the coming weeks, see the post from last week on 04 JUNE here:

https://www.timefarming.com/blog/04-june-2019/

There will be many reports this week after both the crop progress on Monday and the WASDE on Tuesday. I’ll try to sort them out and put something up here about the potential for the corn prices. There will be reductions of both planted acres and the yields coming up and this will be somewhat offset by less demand for USA Corn due to cheap South American product available.

Crude: U. S. Crude oil stocks show a surplus of 46.68 million barrels from a year ago. Announcements for continued cutbacks by Russia and OPEC are expected in the face of slower demand ahead. The USA has not indicated any plans for a crude production cut-back and indeed, more increases are likely. The most widely held opinions are that crude price will continue down a bit. I remain comfortable with my short DEC19 Crude Oil 90C/30P short strangles.

Gold: My short SEP19 1500-stirke CALL options continue with a significant draw down. This option expires in 78 days on August 15, 2019. The Prob. OTM is still around 93%, but I have held this option far past the guideline “200% rule” since it has remained so far OTM. I am likely taking more risk than the premium collected warrants but since I am not heavily weighted (I don’t have a large position in them,) I will wait a bit longer and see what happens.

I’m satisfied with my short DEC19 Gold short strangles 1150 PUT / 1700 CALL positions, and when / if conditions permit, I might extend by selling more short strangles out in the calendar 2020 year in early contracts there.

Comments Continued: With this urgent problem of politics and Mexican tariffs over for now, this could moderate some of the volatility in the stock market and diminish the ‘safe-haven’ buying of Gold we saw last week.

Soybeans: Since, as I’ve mentioned before, the soybeans will move up in sympathy with corn, I’ll wait a while longer and both the crop progress and WASDE reports before selling more soybean NOV19 CALL options. Whatever the outcome of the corn situation, the huge stocks of soybeans and the loss of soybean sales to China due to tariffs and swine flu hog population losses – will very much limit the price of soybeans over the next few months.

Have a great week. I hope the news events allow some new trades this week. All the best – Don

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.