New Trades and Order today: 07 March 2019

Closing purchase Trade today: I bought back the Gold JUN19 1550 CALL 0.20 (shorted at 1.10 minus .20 = $90 profit.)

Enter GTC today: GTC to make closing purchased on the Crude Oil JUN19 75 call @ 0.04

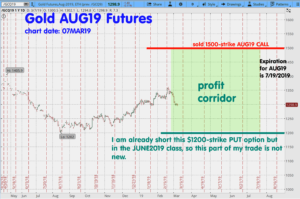

New Trade Today: I sold the Gold AUG19 1500-strike CALL for 2.0 ($200): Since I am already short the Gold 1200-strike PUT (different class: JUN19), I did not have to put up any additional margin money – as these two trades are a short strangle.

FYI: Selling a short strangle with each leg in a different CLASS could be called a “diagonal short strangle” (but this is not important. Just keep in mind the PUT and CALL do not expire at the same time and that’s ok.)

Summary of My Positions:

Today’s Trade: Short JUN19 Gold 1500-strike CALL for 2.0 ($200)

Short strangle:

Short SEP19 Crude Oil 80-strike CALL for 0.17

Short SEP19 Crude Oil 35-strike PUT for 0.09 (total of 0.26 = $260)

Short Strangle:

Short JUN19 Crude Oil 75CALL for 0.11

Short JUN19 Crude Oil 45PUT for 0.24 (total of 0.35 = $350)

Short the JUN19 Gold 1200-strike PUT for 1.40 ($140)

Short the JUL19 Corn 360-strike PUT at 3.125 ($156.25)

Note: I always use examples with a quantity of 1 (one) option per trade. This is not because I only trade one of each option, it is to keep the illustrations simple and easy to understand in the newsletter. Please remember the strategies of the trades I post here are risky, and not suitable for all traders. Posts here are for educational purposes only.

Here’s the chart on the 1500 CALL Gold AUG19:

That is all today. Thank you. – Don

My email is Don@WriteThisDown.com

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

New Trades and Order today: 07 March 2019

Closing purchase Trade today: I bought back the Gold JUN19 1550 CALL 0.20 (shorted at 1.10 minus .20 = $90 profit.)

Enter GTC today: GTC to make closing purchased on the Crude Oil JUN19 75 call @ 0.04

New Trade Today: I sold the Gold AUG19 1500-strike CALL for 2.0 ($200): Since I am already short the Gold 1200-strike PUT (different class: JUN19), I did not have to put up any additional margin money – as these two trades are a short strangle.

FYI: Selling a short strangle with each leg in a different CLASS could be called a “diagonal short strangle” (but this is not important. Just keep in mind the PUT and CALL do not expire at the same time and that’s ok.)

Summary of My Positions:

Today’s Trade: Short JUN19 Gold 1500-strike CALL for 2.0 ($200)

Short strangle:

Short SEP19 Crude Oil 80-strike CALL for 0.17

Short SEP19 Crude Oil 35-strike PUT for 0.09 (total of 0.26 = $260)

Short Strangle:

Short JUN19 Crude Oil 75CALL for 0.11

Short JUN19 Crude Oil 45PUT for 0.24 (total of 0.35 = $350)

Short the JUN19 Gold 1200-strike PUT for 1.40 ($140)

Short the JUL19 Corn 360-strike PUT at 3.125 ($156.25)

Note: I always use examples with a quantity of 1 (one) option per trade. This is not because I only trade one of each option, it is to keep the illustrations simple and easy to understand in the newsletter. Please remember the strategies of the trades I post here are risky, and not suitable for all traders. Posts here are for educational purposes only.

Here’s the chart on the 1500 CALL Gold AUG19:

That is all today. Thank you. – Don

My email is Don@WriteThisDown.com

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.